An all-in digital banking platform addresses the issue of payment delays in Nigeria

Industry

Services

Duration

Team size

About the client

Our client is a US startup with Nigerian roots eager to give users flexibility in how they take their pay.

Ensuring timely wage payments remains a growing challenge in Nigeria. Our client aimed to address this challenge with a responsive digital bank that offers early access to earned wages — a first-of-its-kind offering in Nigeria.

Business challenge

The client sought a novel approach to establish a fintech infrastructure in Nigeria, bypassing the limitations of a traditional banking license.

Our client needed a web-based digital bank, accessible via a desktop web app, that provides an all-in fintech experience with early wage access and allows users to link their existing bank accounts to the app.

From a technical standpoint, the solution had to meet the following requirements:

• Ability to serve 40,000-50,000 user sessions simultaneously

• High transaction speed

• High level of events logging

• Seamless integration with third-party services

• Sustainability for peak user load due to salary withdrawal periods

Implementation approach

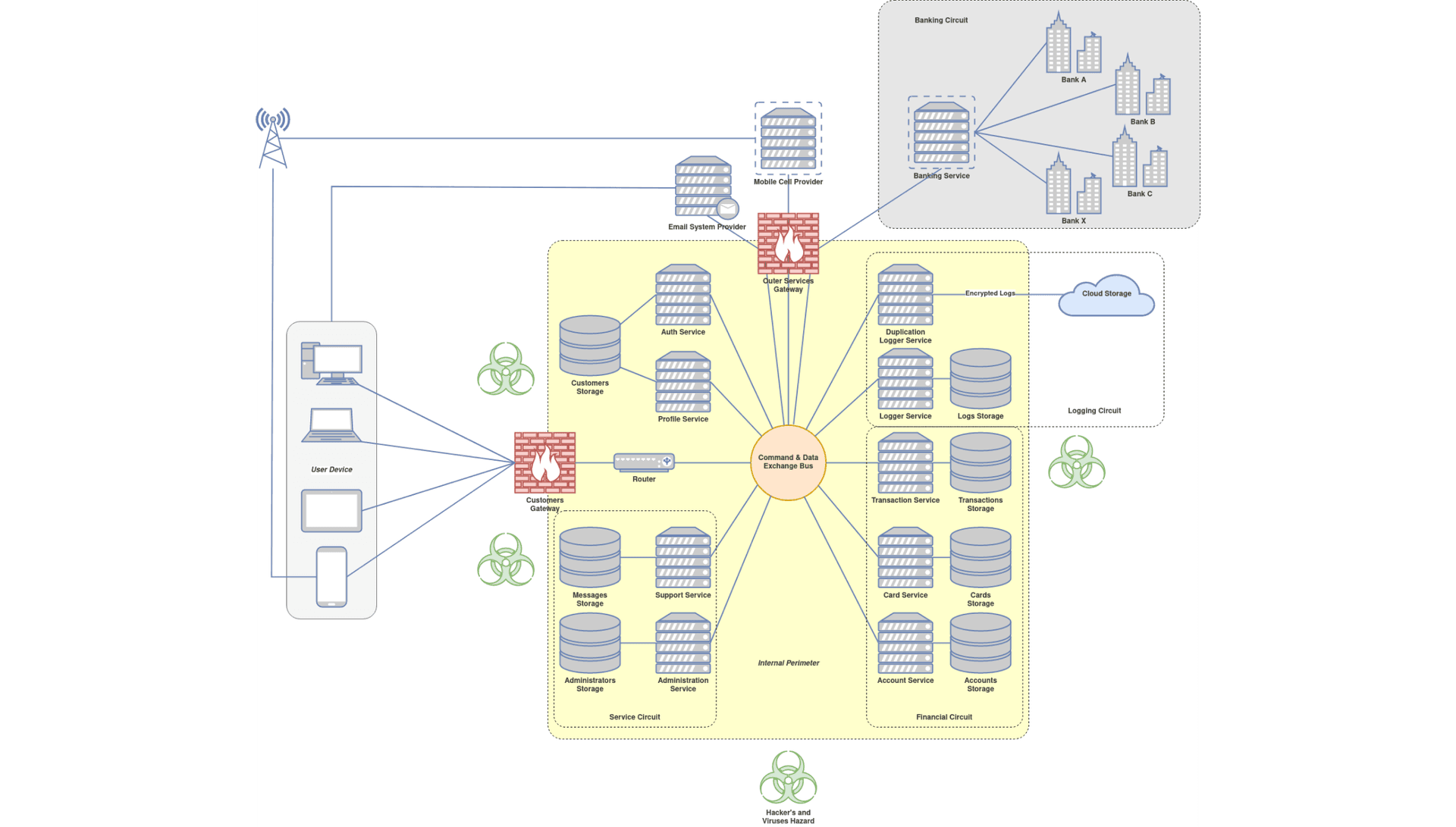

To create a license-free digital bank for the Nigerian market, we selected a Banking-as-a-Service development approach.

Our team analyzed the existing BaaS platforms, considering crucial factors such as cost, maturity, documentation, and supported tech stacks, which led us to Maplerad, a financial operating system perfectly aligned with the client's requirements. Additionally, the selected BaaS platform facilitates early paycheck access, which is a signature feature of our client’s banking app.

Central to our solution was a robust and secure open banking API integration that enables users to leverage the app’s innovative features while maintaining their existing bank accounts.

Delivered solution

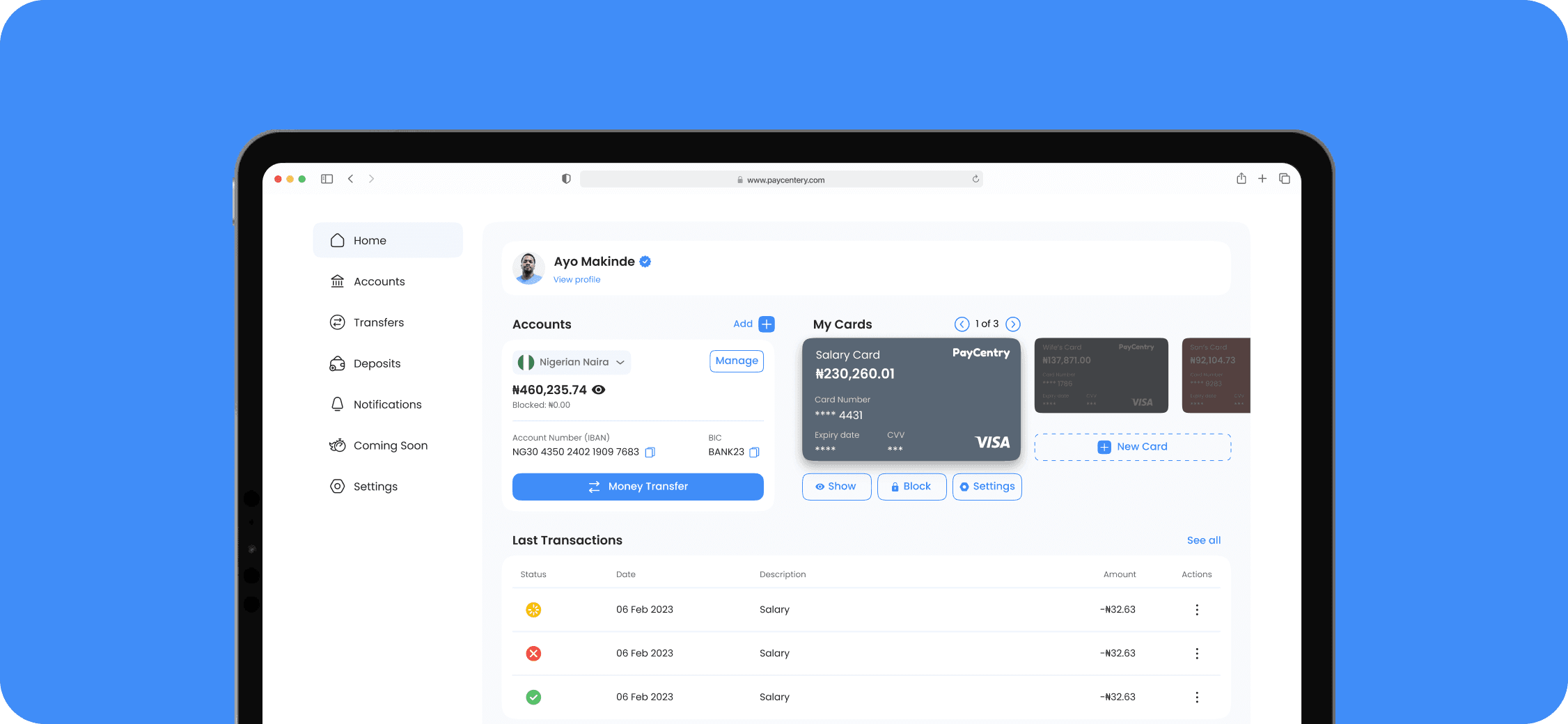

Our solution comprised a user-facing web application and a reliable admin panel connected via a RESTful API to ensure the solution’s scalability and flexibility.

The backend, built on Node.js and the Nest.js framework, employs a stateless architecture for fault tolerance and ease of deployment.

As the system needs to manage a substantial number of requests, including transfers, deposits, and account creation, we selected an auto-scalable AWS infrastructure with load balancers as a server solution to facilitate on-demand scalability.

Key features

Our team delivered the web platform in a series of controlled releases, starting with a minimum viable product. Following the user and stakeholder feedback, we then refined the solution and launched a full-fledged, feature-rich version of a web digital banking app.

Early paycheck access

A standout feature of the app that allows users to access a portion of their earned wages two days in advance.

Account management

Users can seamlessly open and manage bank accounts to send and receive funds, including their salaries.

Money transfers

The app allows users to receive and make transfers to another Nigerian bank and another Maplerad account with the transaction history available at a glance for effortless financial management.

External bank accounts

Based on the integration with the Okra platform, this feature lets users link their existing bank accounts to the app. Users can receive salaries in their preferred accounts while managing finances and using features like virtual cards within the app.

Card management

The app enables users to instantly create, manage, and get virtual cards, granting them the flexibility and convenience of tap-to-pay transactions.

Admin panel

Administrators can execute user and account control, transaction oversight, and virtual card issuance/blocking via a secure admin dashboard.

Technology stack

Frontend

Typescript

React.js

Redux

styled-components

Vite

Maplerad

D3.js

Backend

Spring

Hibernate

Flyway DВ

Lombok

Reactor

JUnit

Prometheus

Grafana

PostgreSQL

AWS

RabbitMQ

Redis

Maplerad

Twilio Verify

Project results

Thanks to our smooth collaboration, the client’s team was able to deliver a digital banking app in six months.

Augmented with features like seamless banking integration and unique offerings like early paycheck access, the app helped our client tackle a major financial hurdle for Nigerians while also providing both employees and employers with a full set of money management functionalities.

Kickstart your digital journey today!

Add your brand's success story to our global list of disruptive brands.

Join the clubWe're trusted by: