In the VC world, pitch decks are often the first filter investors use to assess a startup’s potential. Those slides don’t just tell a story — they indicate credibility, clarity, and vision. For healthcare startups, that signal has to be even more nuanced and sharper. A simple yet compelling narrative, scientific depth, validation, and other key elements have to be combined in a healthcare pitch deck so that generalist VCs, specialist healthcare investors, and strategic partners can each quickly grasp what they’re looking for.

Our team, with over 15 years of experience in healthcare software development, analyzed more than 100 publicly available pitch decks from U.S. healthcare startups funded between 2022 and 2025, during a VC downturn. We reviewed decks that cover every funding stage — from Pre-Seed to Series E — and pulled out the shared patterns, structures, and components that have helped biotech, pharma, digital health, and other healthcare startup founders win over VCs.

What makes a successful healthcare pitch deck? Common pillars

While every deck is unique, our analysis led us to a logical conclusion: funded healthcare startups follow a common structure built around stage-agnostic points that reflect the high-level elements investors consistently look for.

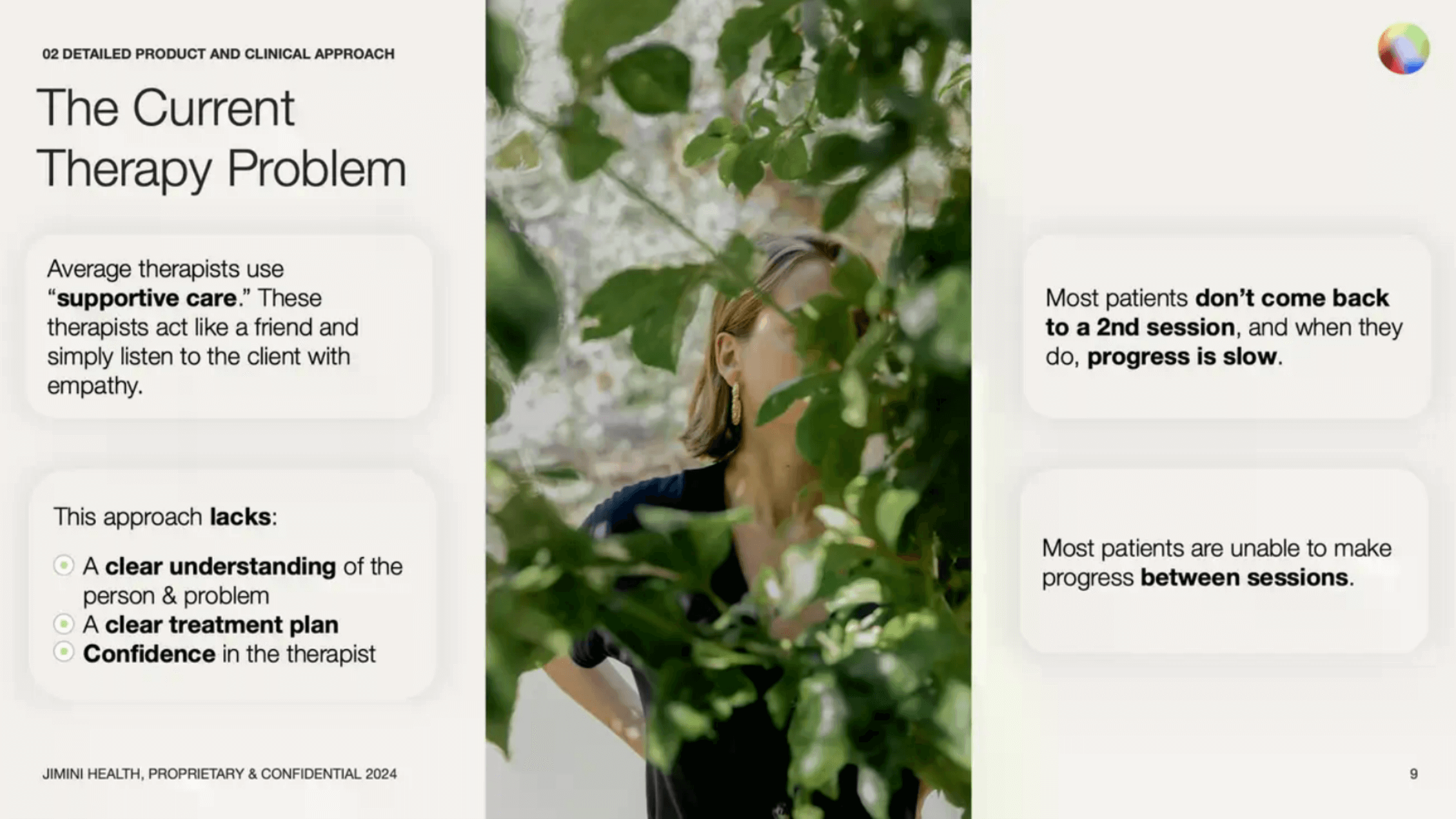

Clear problem and compelling solution

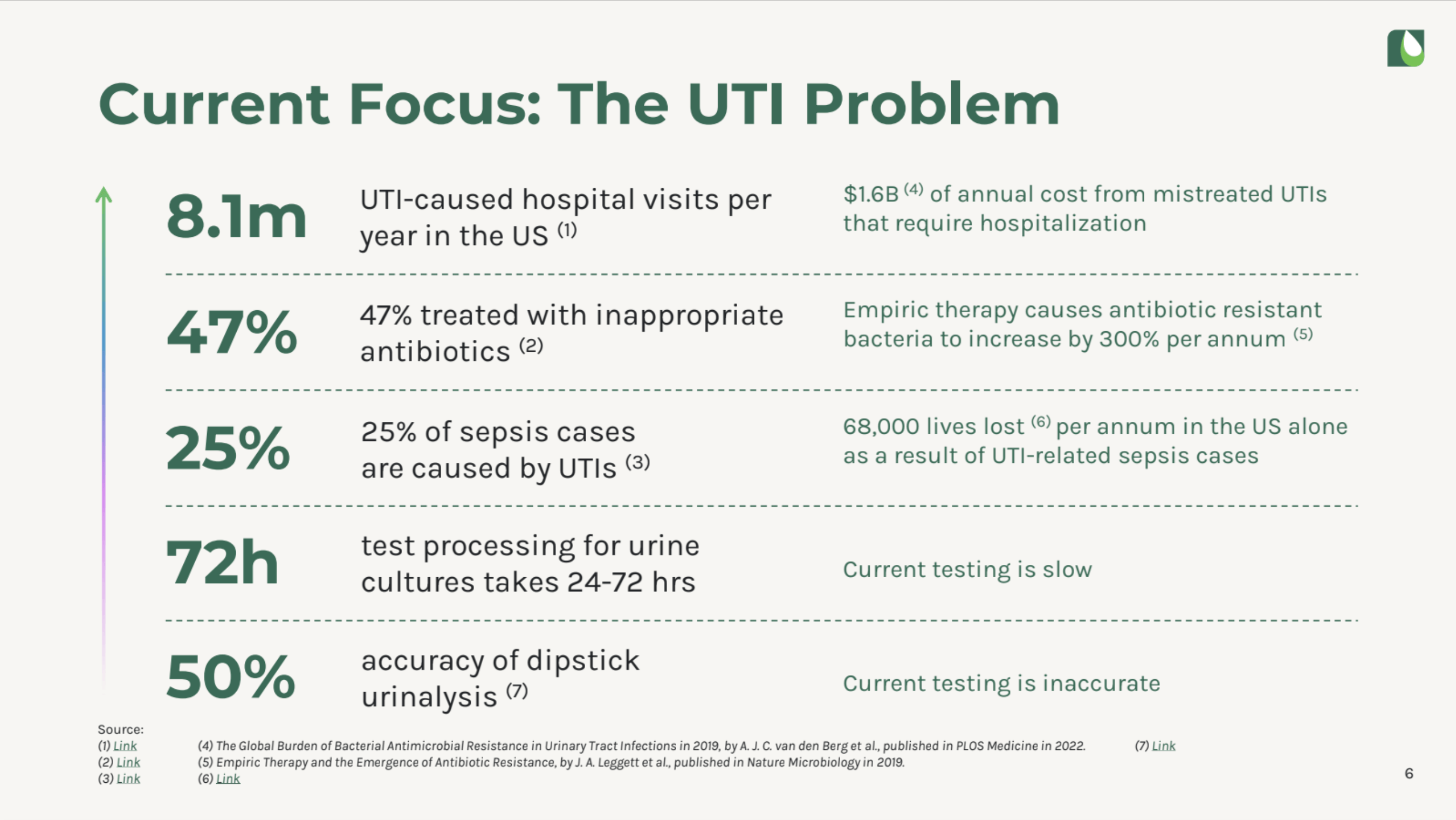

A pitch is a story. In healthcare decks, most stories lead with the problem that patients, healthcare providers, or the healthcare system is facing. But not just some vague, intangible problem. It has to be a specific pain point or unmet need that clearly explains why it matters, who it affects, and how high the stakes are.

In most cases, the problem is supported by hard data, like statistics, numbers, and real-world evidence gathered from clinical studies, market research, or pilot programs.

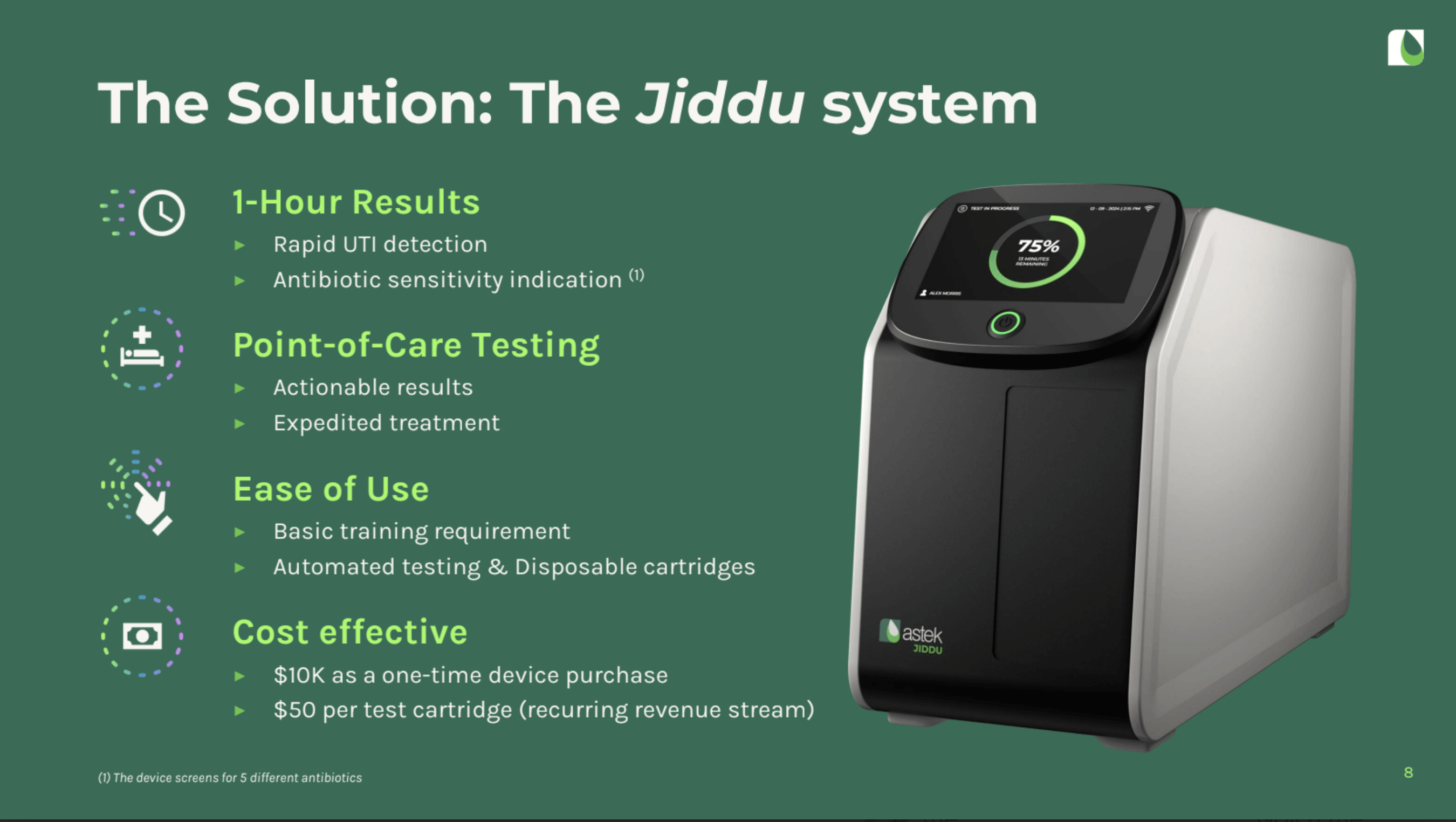

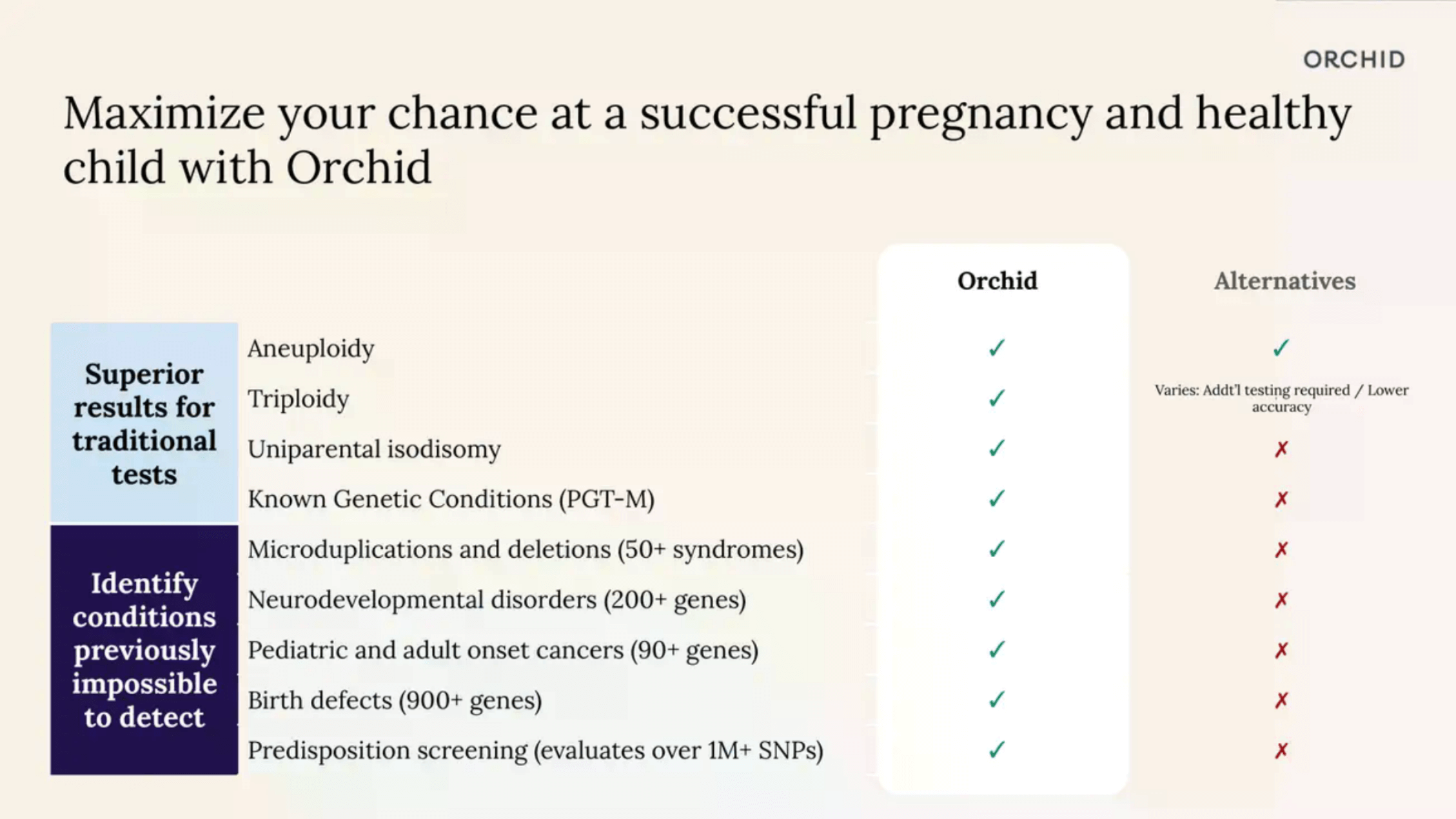

Following the problem comes the startup’s solution. This slide echoes the pain point introduced earlier and focuses on what makes this solution unique compared to competitors, existing therapies, or alternative approaches.

Our research shows that some healthcare startups present the key differentiators on a single slide — along with clinical data, pilot results, or validated studies — and then elaborate on the solution throughout the deck. Other companies take a more distributed approach and weave the solution narrative throughout the deck, gradually revealing the product’s value. Both approaches work as long as the narrative thread remains clear and consistent.

Defined market opportunity

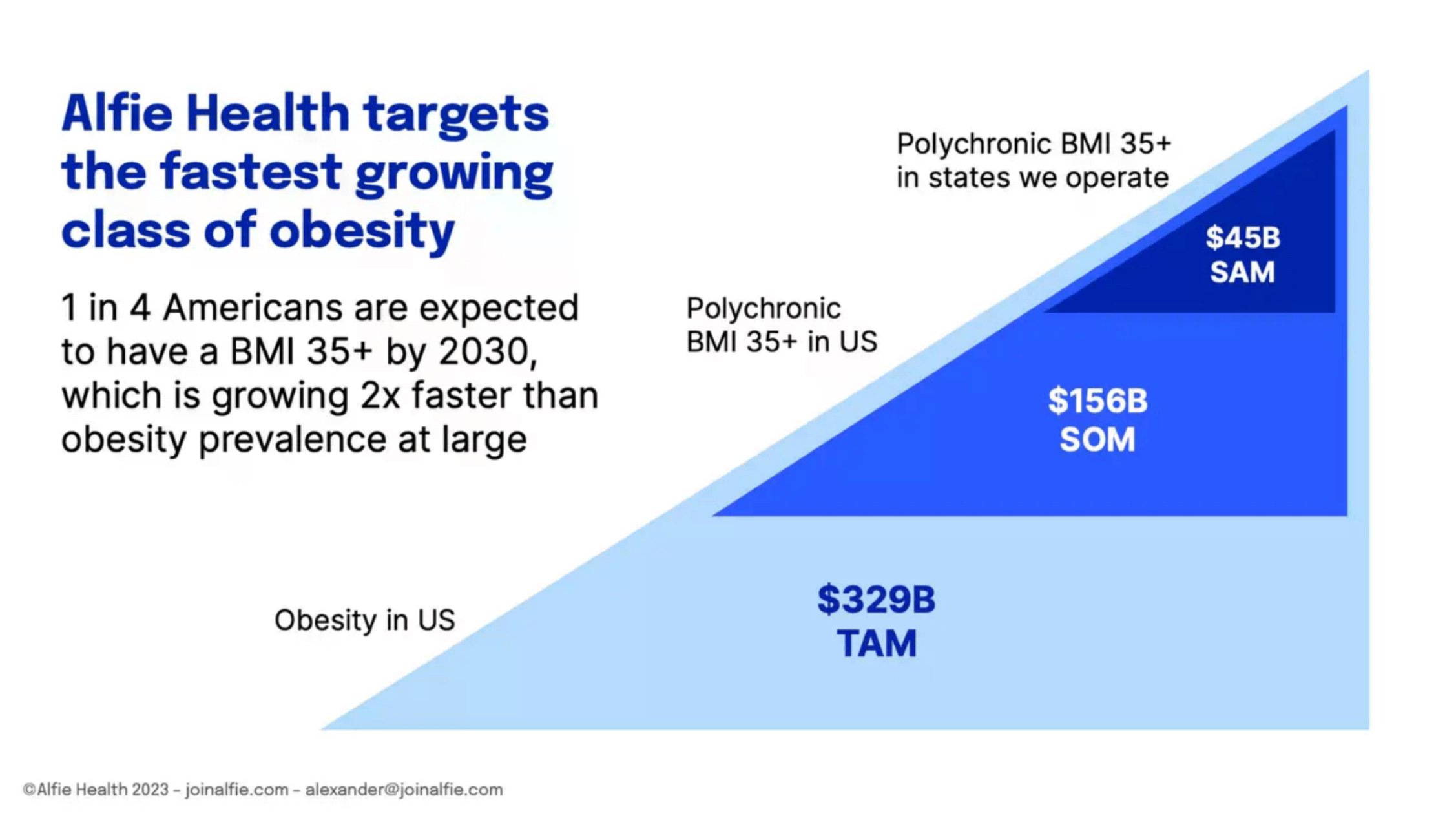

Successful healthcare startup decks don’t just explain who they’re building for. They quantify the market and target audience to demonstrate to investors that they have a grounded understanding of the market size and understand how many individuals or organizations match their ideal customer profile.

Healthcare startups get specific about the segment they’re targeting, whether it’s oncology clinics, Medicare insurers, or diabetes patients, and back up their assumptions with TAM/SAM/SOM figures or healthcare spending statistics. In some cases, startups also break down adoption drivers and barriers — and connect them with their go-to-market strategy to help investors understand whether the startup fits, how it can grow the market, and why the time is now.

Traction and validation

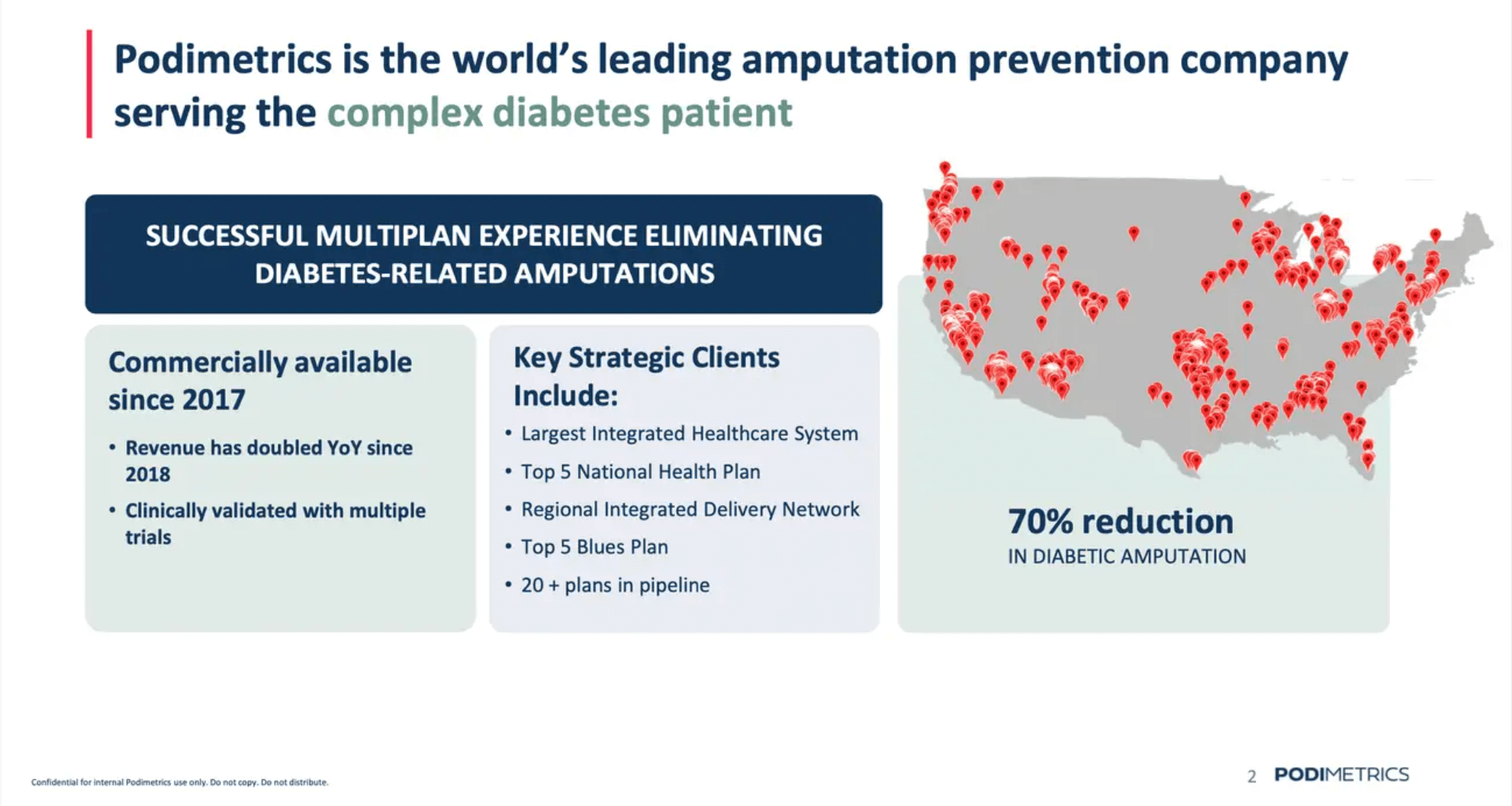

If a healthcare startup has real traction, it typically brings those numbers front and center, especially when in growth rounds. Depending on the niche and business model, companies highlight user or patient adoption data, pilot programs with hospitals, revenue growth, clinical trial results, or regulatory milestones they’ve achieved so far.

For pre-seed stages, that slide doesn’t have to show revenue; it’s more about proving that the product is headed in the right and profitable direction. A strong clinical advisory board, a pilot with a clinic, strong early user retention metrics, a roadmap for validation, or a waitlist of interested providers — all signal the momentum investors look for and that the science or technology actually works outside of a pitch deck.

Business model and financials

Investors aren’t just curious about what the healthcare startup is building. They also want to know whether the startup can generate revenue and scale sustainably. Our analysis shows that winning decks bring forward the real-world mechanics behind the product — who pays, how much, and how that can scale over time.

Specifically, most healthcare startups we analyzed included information about their revenue models (subscriptions, per-patient fees, or SaaS licenses) and unit economics when available.

Although this was a universal point, the approach differs between budding and more established startups. Early-stage companies lead with a pricing strategy and a go-to-market plan, which is understandable because investors don’t expect actual revenue at this stage. Conversely, more mature startups lay out specific financial projections and key metrics (CAC, LTV, burn rate) to demonstrate they’re well aware of their burn rate, runway, and the resources needed for upcoming milestones.

Team and expertise

Healthcare is not an industry anyone can enter without prior experience, let alone claiming to change the status quo. That’s why healthcare investors bet on teams with proven domain expertise — people with clinical, scientific, regulatory, or operational backgrounds that de-risk the startup from day one and boost credibility.

Beyond industry luminaries or advisors, we’ve also seen winning pitch decks highlight team members with complementary skills, like technology, marketing, operations, and other knowledge. Whatever the format, the main point of these slides is to demonstrate that the company has the team and the necessary expertise to take an idea from the lab or prototype to the clinic, market, or patient.

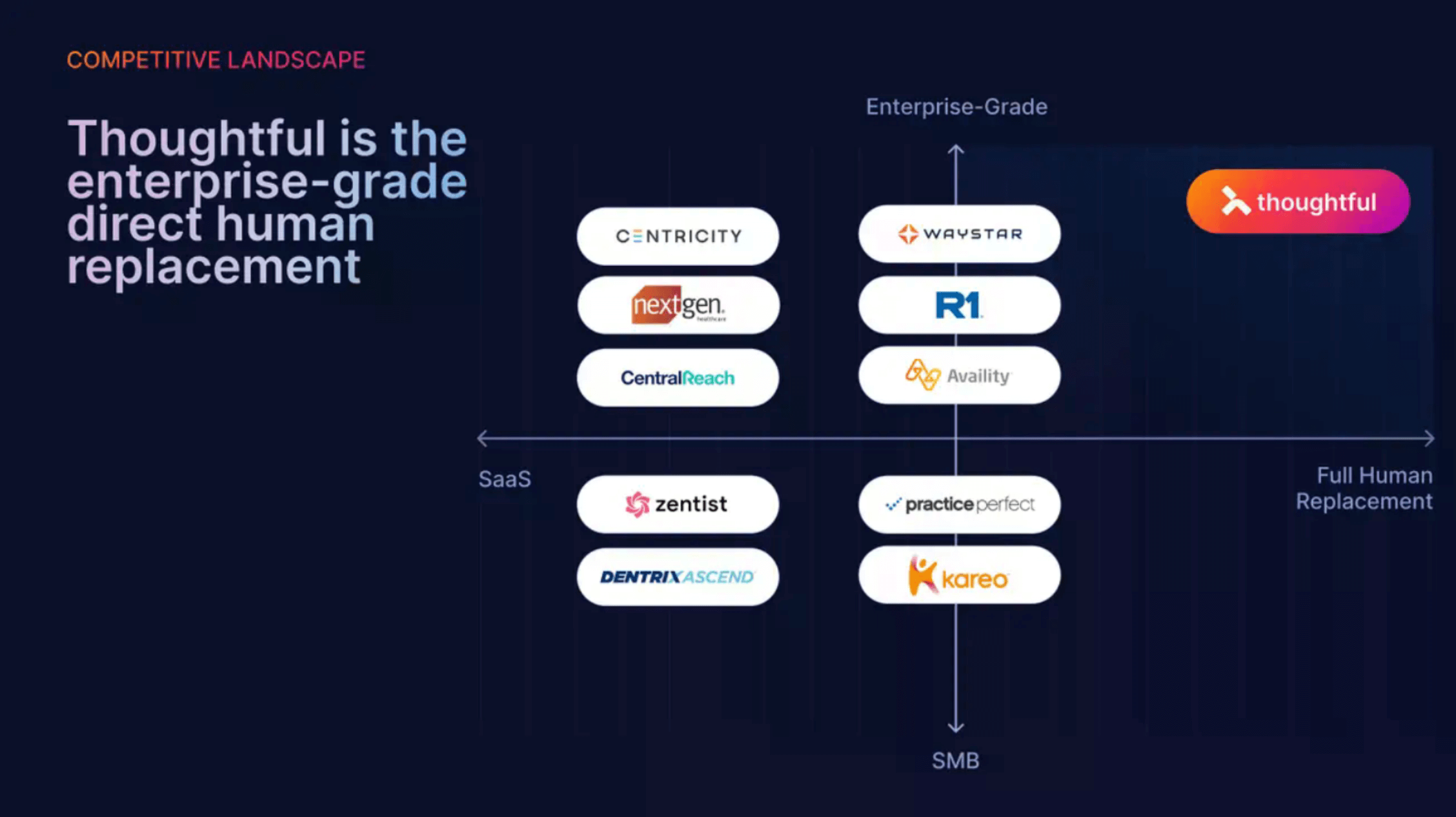

Competition and differentiation

No company launches in a vacuum. So it’s considered good practice to position your solution against existing competitors, because not doing so may suggest insufficient competitor analysis or a limited understanding of the market landscape.

Our analysis of pitch decks shows that some healthcare innovators call out their competitors directly. Others take a more understated approach: they don’t name competitors but let their value proposition and validation speak for themselves.

Healthcare pitch deck essentials by funding stage

Healthcare innovators come with a different story to tell during each funding stage. And the key is to select the right proof points to support the story. Let’s look at how an effective pitch deck evolves at each stage.

Pre-seed: “We’ve found a valid pain point and have the right team to solve it.”

No investor expects a pre-seed startup to substantiate its claims with revenue graphs or growth curves. At this stage, most startups don’t have a fully functional product yet, let alone traction. So the idea, the vision, and the team come to the forefront. Our analysis of pre-seed decks proves this point: healthcare companies that raised ~$2M to $3M in the last three years nailed the story behind their idea – and did so without hard data.

Here are the key points to include in a pre-seed healthcare pitch deck to keep it lean (10 slides on average) yet impactful.

Mission statement and big vision: selling the why

Pre-seed healthcare innovators should sell investors on the vision and why it matters.

For concept-stage healthcare companies, a strong vision slide should:

- Set the stage for the problem they are addressing.

- Show the numbers behind the impact if the problem is solved, including patients helped, costs saved, and lives improved.

- Show ambition without bold claims, underscoring market size and impact.

Founders often open with patient stories to connect with investors on a personal and emotional level. Storytelling also allows companies to communicate the stakes in a way numbers alone can’t, so founders often combine data with stories for greater impact.

Problem/Solution clarity: selling the how

Pre-seed healthcare startups have to pull off a balancing act. They need to convince investors that the problem is real, the solution is plausible and unique, and do so without any heavy traction or financial metrics to rely upon. Decks that secured meetings have one thing in common: they all quantified the burden and offered a direct, logical, and credible response to it.

Surely, pre-seed startups can’t bring much to the table when it comes to validating their solutions. So to make up for limited validation, the pre-seed decks we analyzed highlight early signals whenever possible. This can take different forms, from pilot programs and advisory board endorsements to small-scale outcomes and partnerships with healthcare institutions. Also, pre-seeds often cite published research to show that their approach is grounded in clinical logic, not just an idea.

Founding team’s credentials

When a company is at the pre-seed stage and doesn’t have much data yet, the team slide carries significant weight. Plus, investors evaluate founders based on the capability and passion they showcase at this stage. That’s why pre-seed founders invest significant effort in demonstrating any healthcare expertise, research, or industry connections they have.

Market potential (high-level)

The pre-seed decks we went through start with a compelling, high-level market trend to demonstrate the scale of the opportunity, then zoom in on a specific beachhead to show how they plan to enter the market. The decks tell investors, “We have a realistic plan to capture a small piece of a big pie that is growing fast.”

Although they may be present on slides, precise and defensible TAM/SAM calculations are a less expected element in pre-seed decks, because investors don’t need to see a perfect, granular bottom-up model at this stage.

Product status and next steps

Healthcare investors have become pickier, now leaning towards early-stage startups that can provide a tangible product concept rather than a theoretical construct. This trend is reflected in the pre-seed decks we studied: almost all of them included screenshots to give a sneak peek of the product concept.

Along with that, some funded pre-seed decks contain clear information about the current R&D stage and tactical next steps the company is planning to take to grow the product.

Seed: “We’re gaining early traction and proving product-market fit.”

Startups usually enter the Seed stage competition when they’re already all-in on the development process, with a minimum viable product (MVP) and some early usage data. The seed decks we analyzed came across as visionary, but their vision was backed by real-world data.

Here are the common patterns we noticed when analyzing pitch decks from seed startups that ultimately attracted $2M to $5M+ in funding.

Data-backed problem and market segmentation

Pre-Series A startups still rely on storytelling to connect with investors, but unlike pre-seeds, their stories get more realistic, which is usually achieved with data from their early users. In their pitch decks, seed-stage health tech startups prove that the problem they’re solving is as acute as they’ve assumed before, and they back it up with user testimonials, case studies, or quantifiable outcomes from a pilot.

Seed startups also demonstrate a more nuanced understanding of their target market and include SAM numbers to show that they’ve mapped a path to capturing a measurable share of the opportunity. Target customer profiles are usually also included in the deck to show that the company knows where to direct its initial go-to-market efforts.

Product progress

While a prototype or a demo is a nice-to-have during the pre-seed stage, for seed-stage companies, a tangible early product version is a baseline expectation. Many successful startups include demos, MVPs, and betas in their decks to show they have moved from an idea to a real product and are execution-ready.

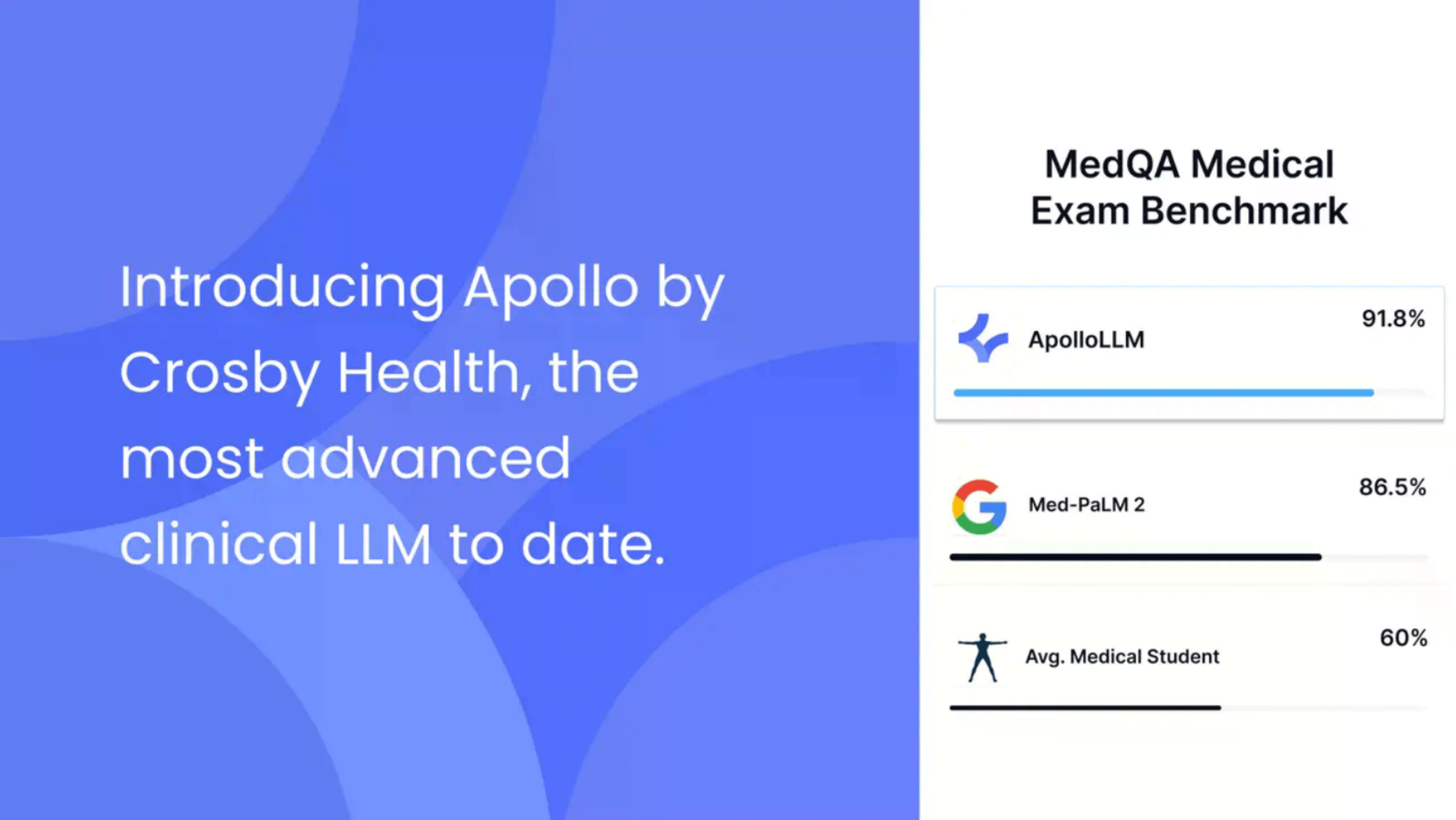

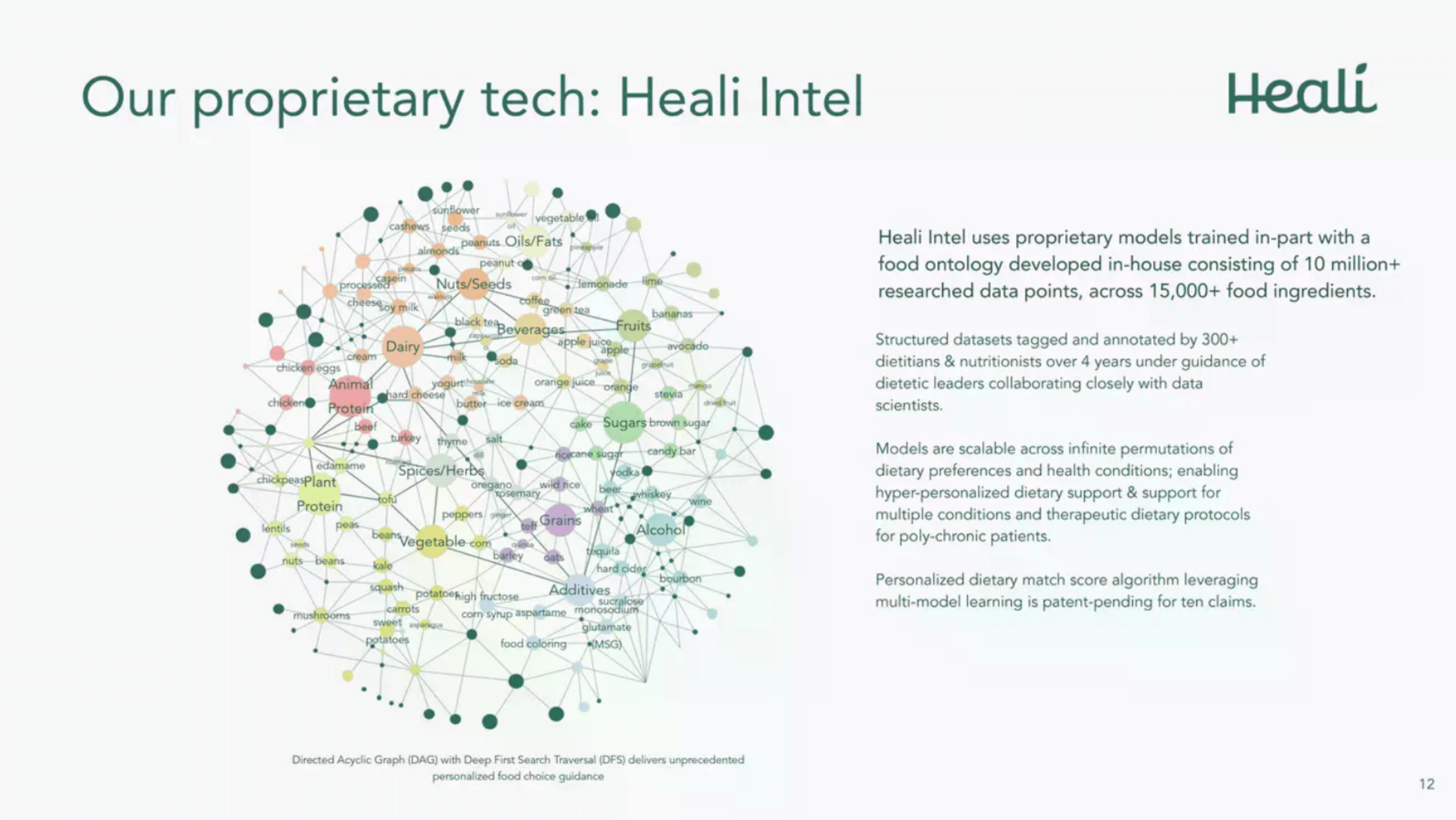

At this stage, many startups also emphasize the defensibility of their technology, because healthcare is a rigid industry that doesn’t tolerate fads. If a startup has intellectual property (IP), such as patents or proprietary technology, it usually allocates a separate slide to it.

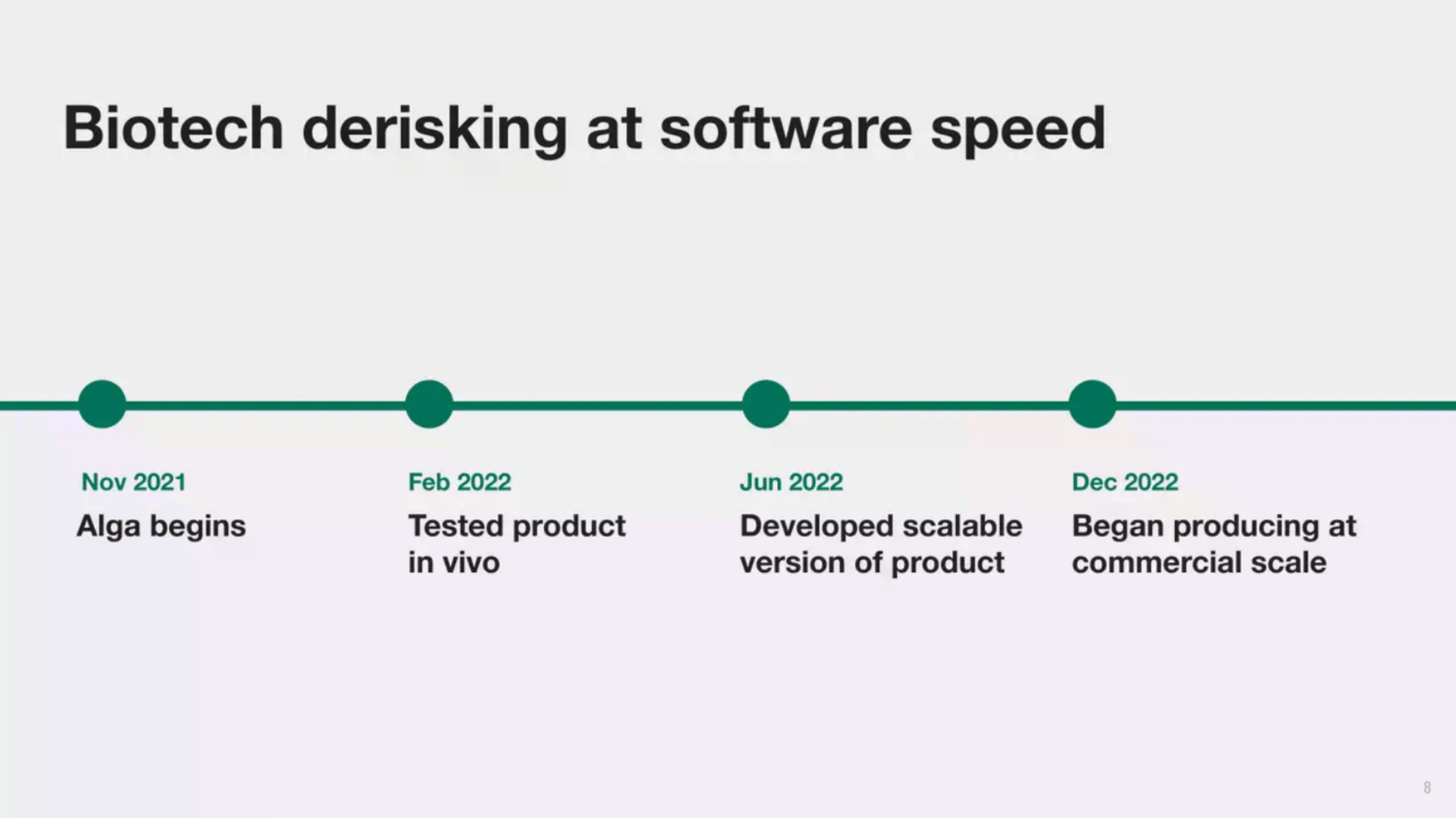

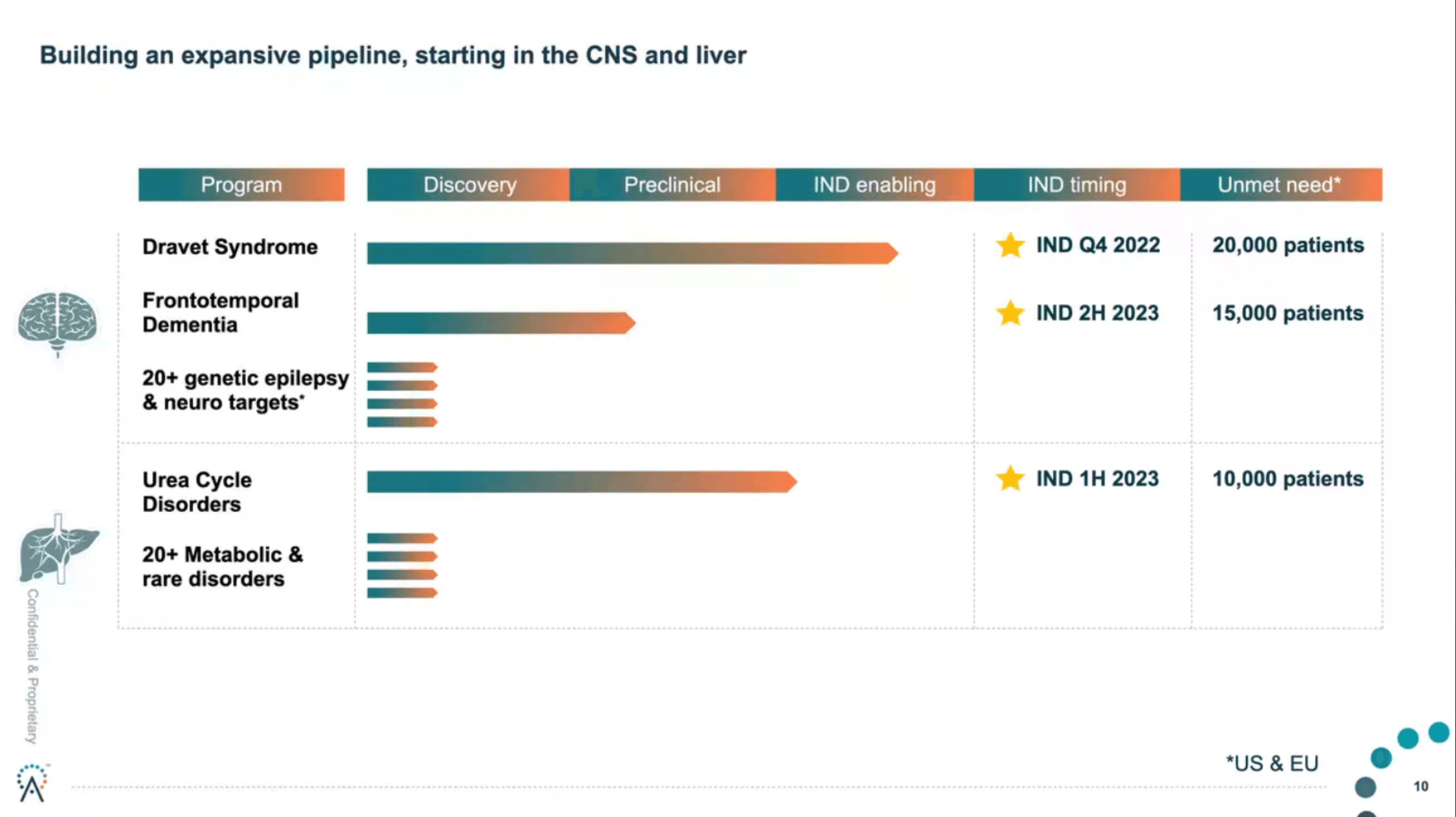

Regulatory path and early validation

According to our analysis, biotech companies, medical device manufacturers, and diagnostics developers also highlight a credible regulatory strategy in their decks. Some companies disclose results from lab testing, while others present a clear regulatory timeline — either way, the goal is to outline an indicative regulatory pathway and the milestones achieved. If the company is pursuing certifications, founders usually explain how they plan to achieve them.

Early metrics and product traction

In our analysis, nearly every seed-stage healthcare company dedicated a standalone slide to the growth trajectory of its product. If the company has any meaningful metrics, be it the number of onboarded users, success stories, week-over-week growth, or any other solid numbers, it makes the most out of them to differentiate itself from a concept-stage initiative. Some seed companies also feature their projections in terms of what progress they plan to achieve in the coming year.

For investors, this slide is clear evidence that the market is responding to the startup’s product and that there’s initial product-market fit.

Team additions

While pre-seed pitch decks often feature a modest slide with a scrappy founding team, seed startups elevate this by highlighting the all-star players they’ve recruited along the way. At the Seed stage, companies make it clear that they’ve addressed any talent gaps they had initially and now have the necessary execution capabilities. Some also include a robust advisory board featuring notable industry experts.

Financials and runway

Investors want to be confident that the round will take the company far enough to either reach profitability or become attractive to Series A investors. To that end, some of the successful decks we analyzed feature a simple financial forecast that answers the following critical questions:

- How much is the startup raising, and how long will the funds last?

- What exactly will the startup spend it on?

- What key milestones is the startup planning to achieve with the investment?

While not universal, some startups also highlight their non-dilutive capital and list the scientific grants they’ve secured. It’s not about non-dilutive capital only. They do it to highlight third-party validation of their technology's scientific merit.

Series A: “We have proof of product-market fit (X ARR)”

Series A is where “it works” must become “it scales”, letting investors know that the company has a replicable playbook for growth and is ready for capital-powered scaling.

Key components of Series A pitch decks fall into the following categories.

Strong traction and growth metrics

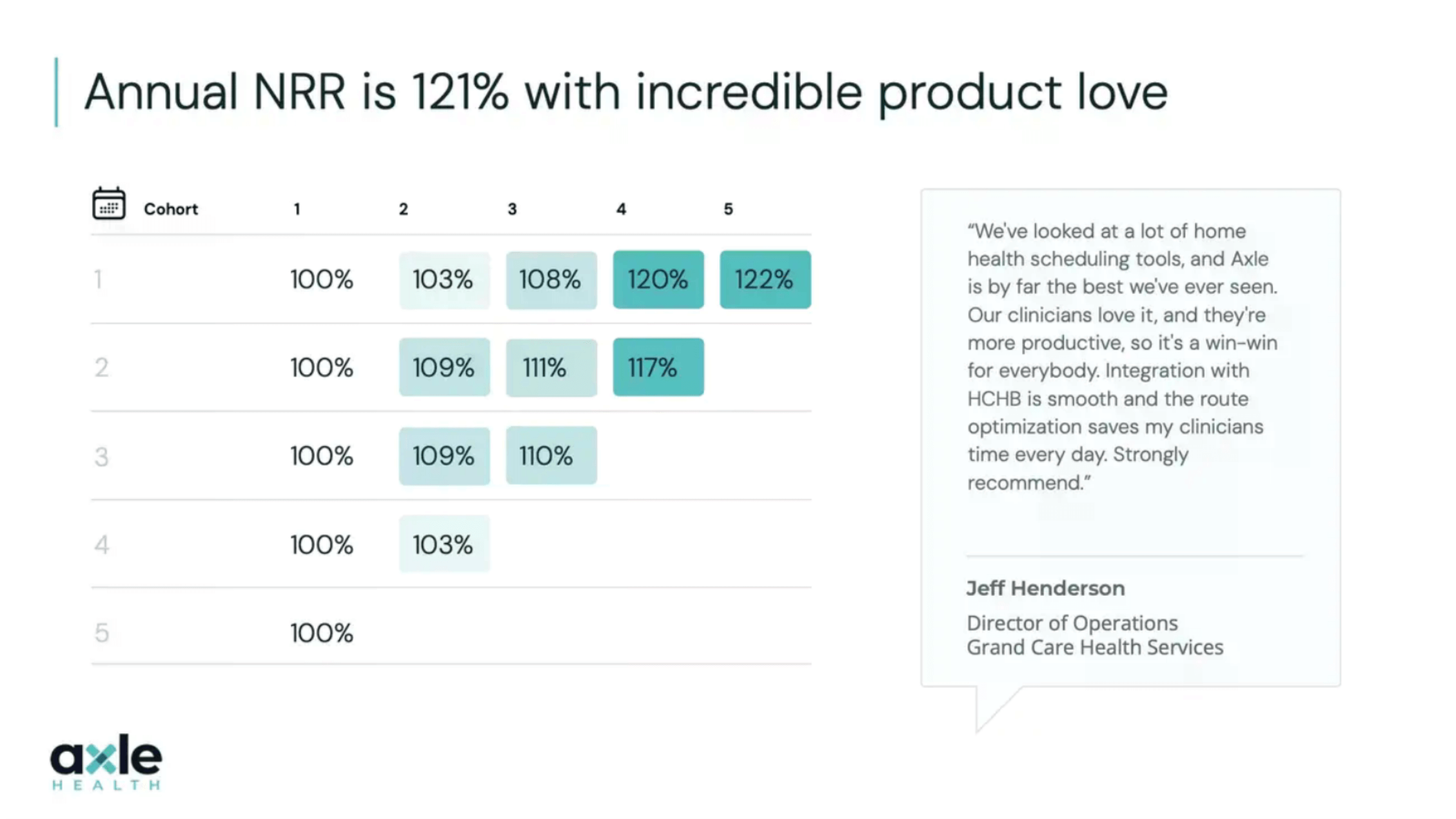

Startups that pursue Series A funding speak the language of scalable, predictable business models backed by clear metrics. The main goal of these slides is to show that patients, providers, or organizations are actively using the product and paying for it.

In Series A healthcare decks, the company’s story revolves around revenue (NRR, MRR, ARR), user growth, engagement rates, clinical outcomes, and other growth-related KPIs.

If a healthcare startup is selling to enterprises, such as insurers or provider networks, founders often explain their sales motions. We’re talking about a clear plan as to how to convert pilot customers into long-term contracts, expand into adjacent markets, or scale distribution.

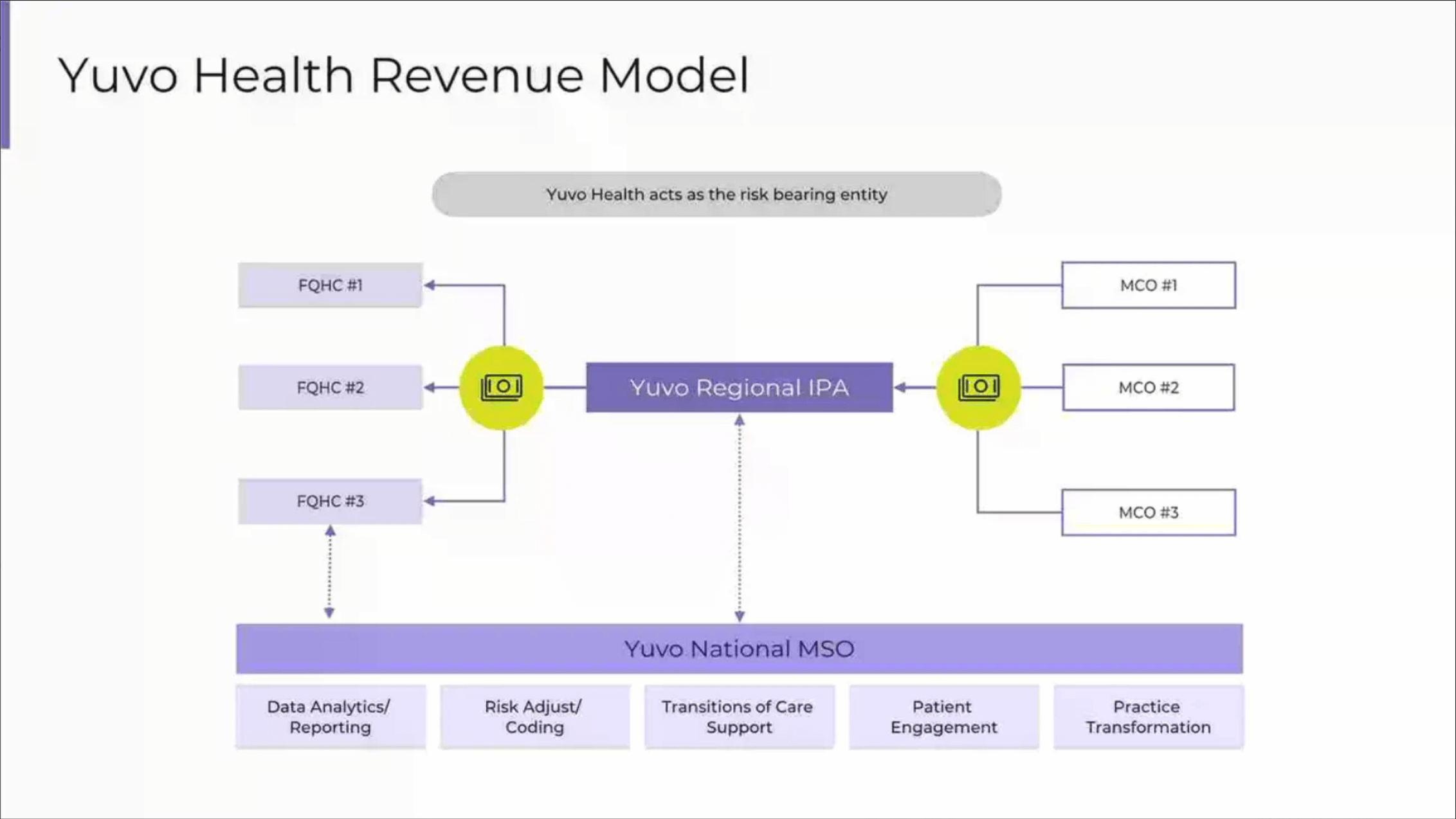

Refined business model and unit economics

While traction serves as a testament to the product value, Series A investors also want to understand how the business actually operates and how growth converts into profit (read: they’ll dissect the startup’s business model). That’s why Series A companies have quite a few slides dedicated to go-to-market strategy, sales pipelines, and unit economics to accompany their traction data.

At this stage, investors want to see that every newly acquired customer is not just revenue, but profitable, long-term revenue. For this reason, Series A decks usually present a clear picture of the company’s unit economics, supported by CAC, LTV, NPS, LTV-to-CAC ratio, and other metrics. If there’s any repeatability in sales, startups always highlight this data to show that they can build a growth engine and sustain it.

Another common thread we observed is that many successful Series A healthcare companies in our research have layered revenue models and a moat built directly into the business ecosystem. For example, Yuvo Health, mentioned earlier, has a unique business model that leverages the network effect by aggregating FQHCs into a single IPA. That is something Series A startups choose to put on display, and for good reason.

Market position and expansion

By this stage, healthcare startups should have a solid grasp of the market they’re winning in and a clear plan for how they’ll build on that foothold. That brings us to the next pillar of Series A decks: a roadmap for expansion. The decks we reviewed included two types of expansion roadmaps: those focused on geographic expansion (e.g., from one state’s hospital system to nationwide) and those focused on vertical expansion (e.g., from outpatient clinics to pharmacies).

If a startup plans to use Series A capital to enter new market segments or launch a new product line, it makes that clear in the deck. Investors want to see a vision for scaling up beyond the initial niche.

Team growth and key hires

Similar to seed pitch decks, Series A decks highlight an extended team, including VPs, CTOs, medical directors, and others, to show that the company has the operational and technical capacity for the next growth round. It’s also typical for Series A startups to flag the industry heavy-hitters or team members with prior entrepreneurship experience they’ve welcomed to the team. The stronger the company’s leadership structure is, the easier it is for investors to trust that team.

Regulatory and compliance plan

A sophisticated Series A investor in the medtech or diagnostics space wants to see a defined, phased plan of how the company is progressing through the regulatory pathway. At Series A, pitch decks no longer present “here’s what we plan to do”. They focus on specific steps the company has already taken to de-risk the scale-up and prepare for regulatory approval – whether through evidence generation, regulatory submissions, or payer engagement.

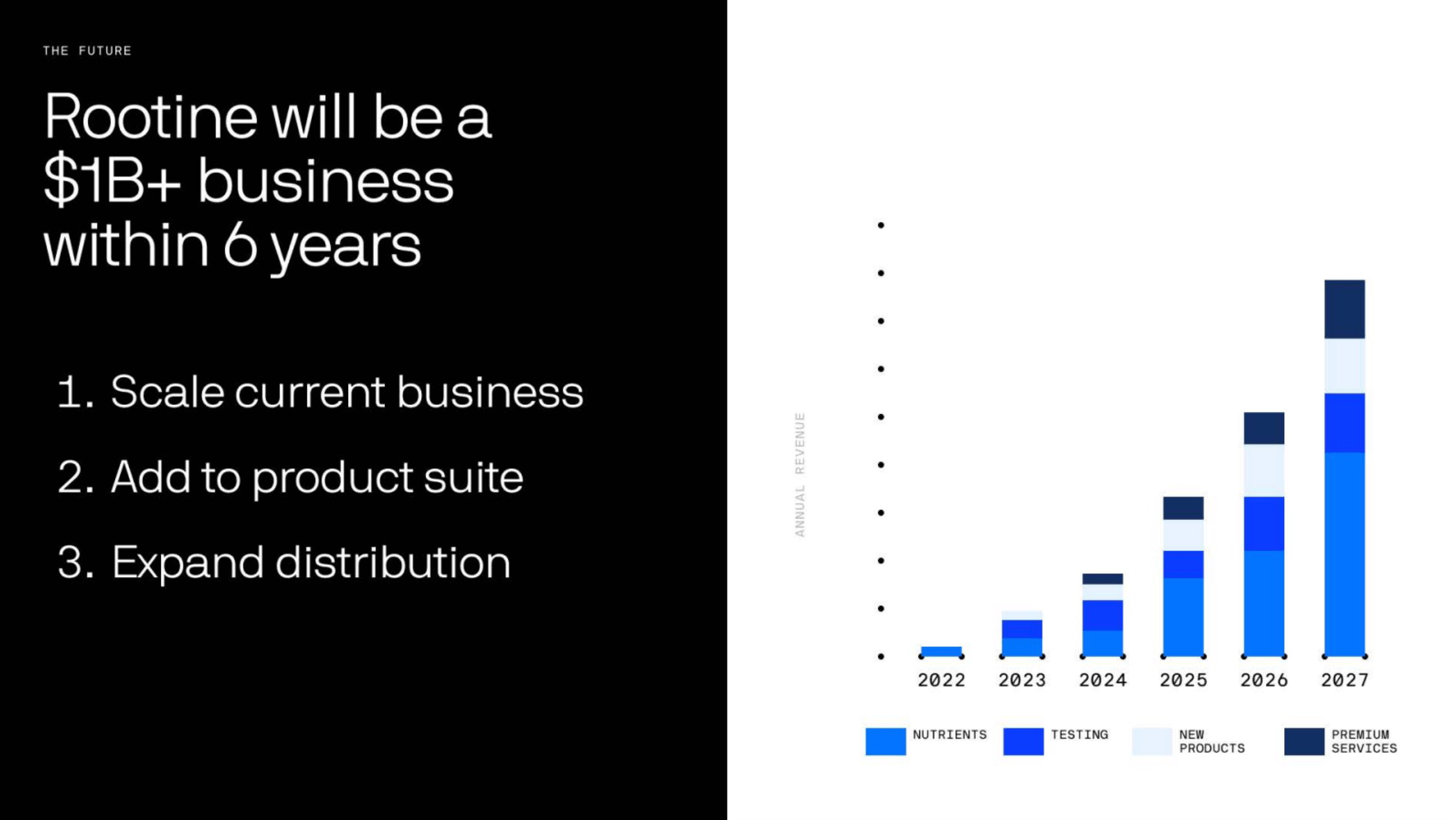

Financial projections

At Series A, investors also expect startups to present solid projections for the years ahead. The best decks tie these numbers to key commercial or regulatory milestones. Even if the company doesn’t go past the break-even point until Series C, founders still need to show a grounded path toward profitability or revenue growth. Many Series A startups also lay out how they’ll use the funds to achieve their revenue targets.

Competitive differentiation

Our deep dive into the healthcare pitch decks revealed that startups typically include competitor analyses in two forms: either as a simple 2x2 matrix or as a detailed head-to-head comparison. Either way, many Series A companies, especially those operating in highly competitive niches, ensure to defend their positions against incumbents and new entrants in front of potential investors.

Series B: “We know how to spend the funds to scale aggressively.”

By the time startups reach Series B, they are usually in a much better financial position and already have significant traction. That’s why Series B funding is always about ramping up production and evolving from a point product to an entire ecosystem. A Series B pitch deck in healthcare reflects this stage by showing that the company has tested and validated its model and now just needs capital to scale.

In a Series B round, healthcare startups often seek larger investments (ranging from $21M to $177M in our analysis), mainly from VCs, private equity firms, or investors who participated in earlier rounds.

Here’s what typically goes into a Series B healthcare pitch deck, according to our analysis.

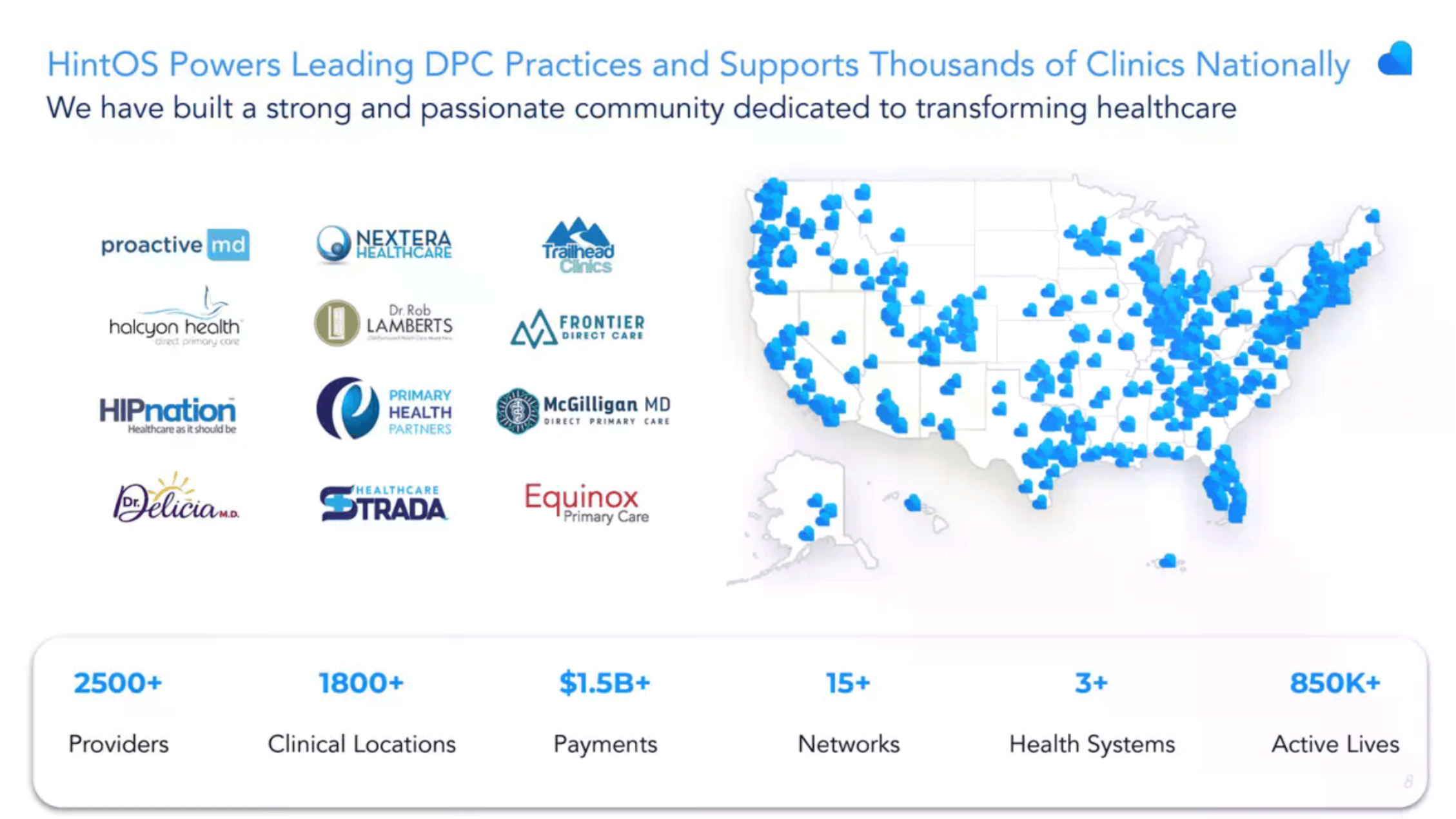

Significant traction and market adoption

Similar to earlier stages, Series B startups break the ice with a background story, but this time, the story leads to demonstrated traction rather than a high-level vision. Series B startups are expected to showcase impressive traction metrics in their decks, like annual recurring revenue, number of paid subscribers, major partnerships with hospitals, and other relevant indicators.

If there are any market leadership signals, be it first-of-its-kind FDA approval, exclusive clinical trial results, or category-defining technology, Series B startups prominently highlight them to demonstrate category leadership.

Growth strategy and dominance plan

At this stage, investors want to know whether the healthcare scale-up will use the capital effectively and how exactly it’ll use the money to expand its moat. For healthcare startups in Series B, traction doesn’t just mean adding more health system clients. It’s more about a coordinated effort that includes the combination of vertical, horizontal, and geographic expansion.

Along these lines, Series B decks often highlight:

- An expanding product or service pipeline

- The shift from "cost center" to "profit center" for their customers

- Key partnerships or alliances that strengthen competitive positioning

- Market share gains and leadership indicators

- Studies and publications (usually put in an appendix)

Operational metrics and unit economics

Series B investors fund hyper-growth, so they need indicators that the company can not only grow revenue but also successfully navigate the scaling phase. In the decks we analyzed, these indicators were abundant — from gross margins and churn rates to clinical trial throughput and CAC payback periods.

Mid-stage healthcare pitch decks really home in on financial details, showing how their unit economics will evolve and improve as they scale and add new products. The decks usually include metrics that go beyond top-line revenue and demonstrate the core financial health of the business model, such as NRR, gross margin, burn rate, sales efficiency metrics, and platform-related metrics.

Team and company building

By the time a startup hits Series B, the team has usually grown to include leaders for product, engineering, sales, marketing, and operations. Investors want to see a strong leadership bench capable of executing at scale — ideally with people from notable companies, successful healthcare firms, or academia. We also noticed that companies often highlight the cumulative experience or significant projects of their team members.

Regulatory or clinical updates

Data platforms and other similar tools tend to emphasize their data security, data governance, and data interoperability capabilities. For medtech, biotech, and diagnostics startups, Series B is usually the stage when regulatory and clinical progress become front and center.

The Series B decks we reviewed all displayed clear milestones, such as completion of IND studies, pre-submission meetings with the FDA, or cleared IDE applications. As for clinical progress, healthcare startups present in vivo proof-of-concept and often the first definitive human data.

Series C and beyond: “We’ve cracked the code on our market, which unlocks new levers of growth (outbound and upmarket)”

Series C+ startups walk with their head held high. They are no longer selling only a vision or a growth story; they are generating significant revenue, have an established customer base, and may even be preparing for an IPO. But that doesn’t mean that their pitch decks are devoid of financial proof and other key signals. Quite the opposite: the proof is now the entire story.

All late-stage decks we analyzed share the following commonalities:

Emphasis on market leadership and scale

Series C/D decks often use words like “most effective”, “leading provider”, and “the only” to underscore their market dominance. And they back this up with hard evidence, like the number of patients served, rankings, press releases, and other objective proof. Essentially, these decks signal to investors that the company is already dominating its market, while the new capital will help it grow several times larger.

Comprehensive traction and financials

Late-stage decks get really technical with the metrics. That’s because by Series C and beyond, investors expect a full, transparent breakdown of the company’s financial engine, including historical revenue, growth rates, customer acquisition costs, LTV, gross margins, and even EBITDA, year-by-year P&L projections, and cash burn. At this stage, scale-ups often include a timeline of their year-over-year growth numbers, starting from Series A.

Traction slides often branch into multiple angles – one for user growth, another for revenue, another for network scale, and another for engagement depth. Late-stage companies want to show every dimension of their momentum and prove that they are on a path to eventual profitability or a lucrative exit.

Expansion and category ownership

Series C+ decks usually present a master plan for how the company will evolve from a successful business into a sticky, category-forming platform. New product lines, new market entries, condition-specific modules, and platformization initiatives get framed as the next steps toward market dominance.

By Series C, startups often partner with health plans, which puts their products in front of entire patient populations. So, it’s not rare for companies at this stage to include payer logos in their decks. Series C+ startups may also show how they plan to use new funding to acquire smaller competitors or expand from hospital systems into outpatient clinics.

Multi-stakeholder value proposition

More mature healthcare startups highlight the depth and breadth of their solution’s value proposition. By showing how their product can move the needle for patients, providers, payers, regulators, and other healthcare stakeholders, Series C+ startups signal to investors that they have achieved ecosystem fit.

In practice, this multi-faceted approach does not require creating separate slides for each stakeholder. According to our analysis, some startups present this multi-party value on a single slide, while others highlight their value proposition to each stakeholder group on separate slides.

Key milestones

It might seem like Series C+ startups are past the point of proving themselves, but even at this stage, a deck still outlines what comes next. Startups mention upcoming product launches, geographic expansions, strategic partnerships, regulatory milestones, IPO or M&A preparation, or technology upgrades. The main goal of these slides is to show that the momentum isn’t just historical– it’s still ongoing.

Clinical and operational workflow integration

During later growth stages, startups also highlight how well their product can scale across complex healthcare environments. Whether it’s EHR integration, cross-provider interaction, or payer platforms, Series C+ decks emphasize that the solution fits seamlessly into existing workflows rather than disrupting them. In healthcare, this is a game-changer and a clear green flag for investors.

Exit considerations

Although this is not included in all decks, some Series D decks hint at the endgame without stating it outright. These hints may appear as subtle comparisons to public companies or IPO-aware narratives. The deck may also include an appendix with 2-3 year financial projections or scenario planning for break-even. Regardless of format, the key idea is to portray the company as IPO-ready or an attractive acquisition, with the growth round supporting that next step.

Conclusion: the anatomy of a winning healthcare pitch deck

Regardless of the funding stage, fundable healthcare startups follow a similar logic. Each deck tells a story tailored to the company’s stage, is backed by hard data, and is designed to demonstrate the company's credibility.

Across 100+ decks we analyzed, the patterns are consistent:

- Early-stage decks focus on the why, with proof coming in the form of pilot programs, clinical reasoning, or advisory board endorsements.

- Seed and Series A decks add traction and sales repeatability to the narrative.

- Series B decks double down on scaling capability and present a clear plan for vertical, horizontal, or geographic expansion.

- Series C+ decks are all about market dominance, scalable growth engines, and subtle cues toward an IPO or acquisition.

But here’s the key takeaway: a winning healthcare pitch deck is only as strong as the product behind it. No amount of optics can mask a solution that doesn’t work, scale, or solve a meaningful problem.

Orangesoft has over 15 years of experience transforming innovative ideas into compelling solutions with a tech moat and built-in regulatory compliance. Whether you’re a budding startup or a high-growth scale-up, our team has got you covered at every stage. Contact us and we’ll take it from there.

Disclaimer: All pitch deck materials referenced in this research were sourced exclusively from publicly accessible platforms. Any visual excerpts included in this article are presented solely for the purposes of commentary, analysis, and research, and fall under fair use as defined by U.S. copyright law. All rights to the original pitch deck content remain with their respective owners.