The year 2022 has been a turbulent year for the global fintech market. From neobanks to insurtech, global fintech investment has slowed but remains the leading sector for venture capital. Global fintech funding reached $75.2 billion in 2022. This is a downward trend compared to 2021, yet the year 2023 paints a bright future for the sector, as the global fintech funding increased by 55% quarter-over-quarter at the beginning of 2023.

As fintech application development continues to gain traction, downloads of fintech mobile apps are growing each quarter. In 2022, the cumulative downloads of financial apps broke a new record of 1.74 billion.

This means now is the right time to join the bankable fintech industry. Today, we'll learn how to develop a fintech app so you can benefit from this trend.

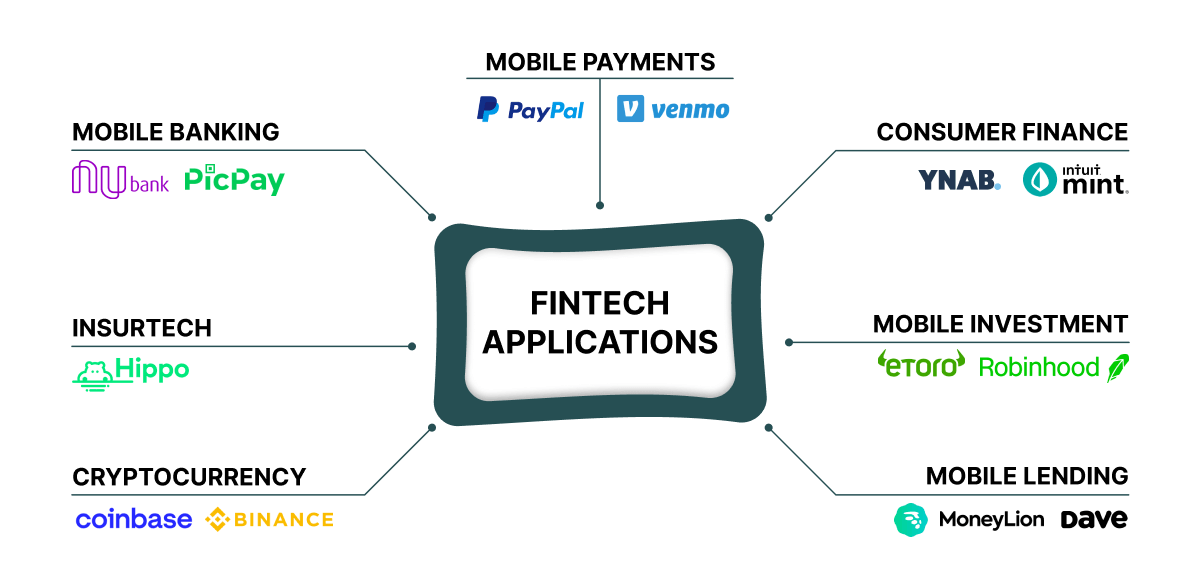

Seven types of fintech applications

Fintech is an umbrella term for a range of software solutions that support digital transactions. In layman’s terms, financial technology can refer to all tech improvements in the financial industry. In fintech application development, the type of your solution will define the core functionality and the overall development direction.

To get a better handle on the fintech ecosystem, let’s go over the most popular types of fintech mobile apps.

Budgeting and financial planning applications

Personal finance or budgeting apps help users better allocate their budgets and monitor their expenses. Using fintech apps of this type, consumers gain a holistic view of their income-to-expenses ratio and can plan their spending. Many even group their spending into different buckets, so they know exactly where their money goes. According to CustomerThink, over 60% of smartphone users have at least one personal financial app.

The following solutions are great inspirations for apps in the niche:

- Mint is a one-stop budgeting application that puts users’ spending into budget categories. Heralded by CNBC as the best money-tracking app, Mint boasts over 25 million users. The app generates revenue through referral fees while being free to download.

- YNAB application provides users with insights into their budgets and expenses. The app earns a spot on Forbes Advisors’ Best Budgeting Apps and is worth strong consideration for helping meet users' budgeting needs. The app's business model is based on monthly subscriptions.

Cryptocurrency trading applications

Blockchain-based services are in vogue at the moment, with estimated global spending of $19 billion by 2024. Cryptocurrency applications account for the lion's share of the market and facilitate trading and exchanging cryptocurrency coins. Demand for this app category is highly dependent on cryptocurrency prices and the broader decentralized market.

The hall of fame includes:

- Coinbase is the largest and most popular cryptocurrency investing and trading platform. This finance app has around 108 million verified users. According to the company, the app revenue increased to $3.1 billion in 2022. The platform makes money via fees it charges when trading, staking, or converting crypto.

- Binance is another example of a cryptocurrency app, with 120 million registered users. As reported by CryptoQuant, Binance's annual revenue grew 10x over the past years and has reached $12 billion in 2022. The app generates revenue from multiple sources. These include trading fees, interest on loans, cloud offerings, interchange fees, mining services, and others.

Mobile payment applications

Paying for goods and services has never been easier than now. Mobile payment apps allow users to add their credit or debit cards to facilitate cashless transactions. Thus, payment apps enable unified payment interface (UPI) transactions without physical cash or cards. The growing popularity of these apps is secured into the future, with a projected number of wallets to increase by 74% in 2025.

Let’s look at the top drawer of payment apps.

- Venmo is a well-known digital wallet that allows for fast and easy mobile payments. In 2022, Venmo’s revenue increased by 10% to $935 billion. The business model canvas sits on interchange and withdrawal fees, affiliate commissions, and other types of fees.

- PayPal is a granddaddy among virtual payment solutions that have gained worldwide recognition. In 2022, PayPal’s net revenue was $27.5 billion, while total payment volume surged to $1.36 trillion. The app has a few revenue streams, including customer transaction fees and other value-added services.

Mobile banking applications

The popularity of digital banking apps is growing at a rapid pace. In 2022, 91% of millennials and 95% of GenXers use mobile banking apps. At the same time, 60% of Baby Boomers have these apps installed on their smartphones.

The landscape is blooming as well. Thus, neobanks have entered the market to compete with traditional banking tech offerings. The average monthly time spent per user for top neobanks trailed traditional banks by only 3.5 minutes in 2022.

Average monthly active users among the top five neobanks in the US climbed from 1.4 million in 2020 to 2.2 million in 2022. However, the top five traditional banks still averaged more than 10x the number of MAU as neobanks.

- Nubank is the leading independent neobank with a global presence. The neobank is 100% digital and uses a mobile app to support its customers. The company reported a YoY total revenue increase of 182% in 2022, which translates to $4.79 billion. The revenue model is predicated on multiple sources, including interchange fees, interest on customer deposits, overdraft fees, ATM withdrawal fees, and subscriptions, among others.

- PicPay is a large Brazil-based mobile banking app with more than 65 million users. According to the company’s report, the annual net revenue of this app reached around $580 billion in 2022. Its business model is unique and relies on its social payments, digital wallet, financial marketplace, PicPay store, and ads.

Insurance applications

Going mobile in insurance means simplifying payments, claims to file, and other insurance-related activities. Insurtech market growth is estimated to persist and reach $33.73 billion by 2025. This market advancement is backed by the increasing number of insurance claims as well as the growing coverage of life insurance. Also, the majority of insurers are now focusing on digital transformation to reduce operational costs, as suggested by McKinsey.

- The Lemonade app is an insurance app from America’s top-rated insurance company. The application covers a great number of insurance offerings, including home, condo, car, pet health, and term life insurance. Launched in 2016, the insurapp’s revenue surpassed $256 million in 2022. Their annual recurring revenue is the result of fixed fees when customers buy the insurance.

- Hippo is another smart insurance app that uses IoT devices to detect issues within a home. The app’s business model is based on commission fees. This innovative app accounted for $119.7 million in revenue in 2022.

Lending applications

The market size of global digital lending platforms is estimated to leap from $5.58 billion in 2019 to $20.31 billion by 2027. The traction gains of alternative lending are attested to by the peer-to-peer system that amplifies the apps. Users bypass traditional banking institutions and can easily take out a loan in mere minutes.

- Dave is a digital solution for easy paycheck advances that help users cover small expenses. This neobank-type application raked in around $205 million in 2022, a 33% YoY increase. The app generates revenue from fees and cash interest.

- MoneyLion is a personal finance and lending application. In 2022, the company reported net revenue of $340.7 million, a 99% year-over-year increase from 2021. Moreover, the total number of customers grew by 97% to 6.5 million. The app's business model is based on loan business, lead generation, and subscriptions.

Investment applications

Investing is also going strong on mobile in 2023. An investment app offers increased accessibility to stock markets and a more detailed look at users' investment portfolios.

- Robinhood is a zero-commission online brokerage app that allows investors to buy and sell stocks for free. In 2022, the company reported net revenue of $1.36 billion. The app generates income via rebates, added services, fees, and cash management.

- eToro is another commission-free app that eases access to financial and trade-copying services. In 2022, their reported revenue was $631 million, with 31.4 million users in December 2022. Like other apps in the niche, eToro makes money through the spread it applies to trades as well as multiple fees.

Fintech app development trends

Knowing the solution type you want to launch is not enough for fintech app development. Over the last years, the industry saw steady growth backed by burgeoning technologies. The fin-vestment boom, in turn, gave birth to new solutions and services that are based on some of the hottest technologies. So, let’s see what tech wonders your customers expect to see in your financial product.

Blockchain

The modern fintech revolution is spearheaded by distributed ledger technology such as blockchain. Thanks to its decentralized and immutable nature, blockchain can disrupt legacy financial processes and transform them into transparent transactions enabled by secure, fast procedures.

The benefits of blockchain in finance also include improved customer experience (up to 25%) and boosted efficiency (up to 40%). The app ecosystem of decentralized solutions is already vibrant.

Thus, the number of decentralized applications has surpassed 8,000 in 2022, with over 800 new dApps since 2021. Other popular applications of blockchain include decentralized exchanges, lending, crypto trading, prediction markets, and other DeFi solutions.

Artificial intelligence

Artificial intelligence is a staple for most digital solutions, including fintech applications. Thus, AI in fintech had a market value of $7.87 billion in 2021 and is projected to reach $41.1 billion by 2030. The application area of smart systems in fintech is massive. From fraud detection and churn prediction to optical recognition, artificial intelligence optimizes trading activities and enhances personalized customer experience.

Generative AI

The current pace of technological change requires fintech leaders to move quickly on AI opportunities. Generative AI and GPT-like language models present an opportunity with an accelerating value for fintech companies, thanks to broad automation capabilities. The global generative AI market is poised to grow from $10.16 billion in 2022 to over $103 billion by 2030, growing at a CAGR of 33.7%.

Cutting-edge fintech startups and incumbent banks pile into the technology to deliver personalized customer service, streamline customer support, automate analysis, and support other critical functional areas. Stripe, Morgan Stanley, and J.P. Morgan are just a few lighthouse adopters of the technology. However, the full-scale adoption of Gen AI has yet to gain traction, as security and interpretability risks prevent companies from integrating it into their stacks.

Big Data

Today, 66% of customers expect companies to understand their needs. For this exact reason, Big data analytics is a linchpin for fintech apps. In fintech, customer empathy stems from the insights extracted from Big Data. The latter is produced by transactions, credit scores, and other in-app financial tools. Using this data, businesses can foresee customer actions, adjust bank policies, and map strategies for growth.

Microservices

Finally, if you are looking to build a fast, reliable fintech app, you should consider a microservices architecture. The hallmark of microservices is an innovative database architecture that enables easier scaling than legacy systems.

Moreover, a microservices architecture provides enhanced security, seamless integrations, and faster deployment. This bag of benefits is the main reason why the approach was adopted in 37% of organizations in 2021.

How to make a fintech app: Step-by-Step

The roadmap of a fintech app development is similar to that of other domains. Hence, getting your solution to the market includes a consistent app development lifecycle with traditional and niche-specific milestones. Let’s have a closer look at the main steps.

Choose your niche and ensure legal compliance

Before starting the development process, you should assess the market viability of your future solution. To do that, decide on the app type, target audience, and main competitors. This information will help you narrow down and define the key requirements for the future solution.

Moreover, regulatory compliance is crucial in this domain. Common compliance acts and rules for the fintech niche include:

- GDPR – a legal framework for data privacy in the EU market.

- CCPA – a state-applicable data privacy law for California residents.

- Financial Action Task Force Recommendations – a fintech standard that prevents illegal financial operations, among other crimes.

Mind that most regulations are location-specific, so you need to research the target market.

Shape the concept and define the feature set

The next step of the planning stage is to solidify your development requirements and business objectives. The more accurate and clear your functional requirements are, the more satisfying the final product will be. A detailed project description then lays the groundwork for defining must-haves and optional functionality. Ideally, your development team should perform meticulous business analysis to evaluate, based on the competition and user insights, how relevant each feature is.

Design compelling UI/UX

Now, it’s time to bring the app's exterior to life. The app interface is a crucial part of your solution that interacts with and draws in new loyal users. Therefore, this aspect of development gobbles up a significant amount of time and resources.

At this step, your design team will establish a coherent design strategy based on content requirements and competitor research, as well as user personas, stories, and customer journeys.

The result of this stage is a final layout that includes a detailed design description and covers the states of all app screens. This way, your fintech app developers can have a clear view of how the application will look and feel.

Choose the development approach

Once your vision is fully shaped, you need to decide on a relevant tech stack and team structure. The technology set is directly linked to the system specification and complexity of your project.

Moreover, your technological choice will depend on:

- App functionality;

- Flexibility and scalability requirements;

- Time to market;

- System load requirements;

- Platforms (web, native, or hybrid apps);

- Security requirements;

- Automation objectives (for AI-based solutions).

As for the team structure, it is largely driven by the same technical factors we’ve mentioned above. If your app is of medium-to-complex functionality, your fintech app development team has to spend more hours developing the system, while a simple-to-medium solution is faster to create and requires fewer resources.

Estimate time and costs

Once the planning stage is complete, your partner fintech app development company will estimate your project's costs and timeline. We at Orangesoft offer multiple engagement models to cover unique client needs. Whether it’s the fixed-price approach or the time-and-materials (T&M) option, make sure to assess the pros and cons of each. Thus, the T&M model is better for undefined budgets and requirements, while monthly fees are a better fit for well-estimated projects.

Develop an MVP

A minimum viable product (MVP) is an early version of your application that includes only the essential functions. However, the functionality must be sufficient for your end users to test the application.

Launching an MVP first allows companies to test the waters without significant investments in unnecessary functionality and to maximize their return on risk. Once your MVP is tested by real users, the team can make further improvements to launch a full-fledged application.

Improve and support your fintech app

The development process doesn’t fade out with the product release. Application maintenance is equally important to ensure your solution remains competitive and user-friendly. Since the fintech market is evolving, regular maintenance is especially important to address growing user and technical needs.

Core fintech app features

A perfect combination of technologies is what can make or break your financial product. To help you handle the how-to-build question for your fintech app, we’ve curated the trending functionality present in most fintech applications.

Privacy and security

Security compliance should be at top-of-mind when building any fintech app. Moreover, the financial sector is highly susceptible to data breaches alongside rising data leak costs. To ensure security compliance, your fintech app must be integrated with robust authentication and authorization systems. Biometric and two-factor authentication are the go-to security options. Thorough testing, API security, and payment blocking will also keep hackers at bay.

Payment gateway integration

To enable cashless transactions, your solution must support one or more payment methods. Ready-made payment gateways will allow your app to process transactions via Stripe, PayPal, or Braintree. Bank APIs also empower applications with financial services with no hassle of having your own banking license.

Alerts and notifications

Push notification is a staple feature for any application type. This feature allows businesses to connect with their customers directly and provide updates on current services. Alerts also help brands engage users with highly curated content, thus boosting revenues and increasing customer loyalty.

Transactional updates, security alerts, and financial planning tips can also be channeled via notifications.

Dashboards and reporting

When the app welcomes the user, it should display all key data on a single screen. This way, the user will have a full understanding of their assets, spending, and incoming transactions. However, the reporting feature must be designed with usability in mind.

AI-powered chatbots

AI-powered voice assistants can reduce the workload on customer service agents while effectively mapping the user journey. In-app chatbots can also up-sell and cross-sell financial services as they interact with the users. Finally, smart assistants increase user engagement and help your app stand out from the rest.

API integration

APIs, or application programming interfaces, are a win-win scenario for both developers and companies. These mechanisms allow two software components to share data, thus eliminating the need to build an additional feature for your application. For example, API integration enables users to access their checking account information or make purchases via PayPal.

QR code and card number scanning

Optical character recognition is another valuable addition to your application. This technology allows users to scan their credit and debit cards without manual entry. Card number scanning links users’ payment details to the app’s functionality, thereby encouraging customers to make more purchases.

QR codes also facilitate faster payments. Thus, users can simply scan a code to transfer money between accounts.

How much does it cost to build a fintech app?

There is no single estimate that holds true across all applications. The development cost will depend on the following cost drivers:

- Functionality and complexity of your application;

- Native app development (iOS and/or Android) or cross-platform;

- Number and nature of integrations;

- Dashboards and animation;

- Cutting-edge features (blockchain, AI, and others), and more.

At Orangesoft, we’ve developed fintech apps within different price ranges. Some apps may cost up to $300K to build, while simple-to-medium solutions stand at $80K.

If you’re wondering how to build a fintech app without overspending, we recommend launching an MVP first. The MVP will allow you to plan further development budgets while having a better understanding of core features.

How to monetize your fintech app

Monetization models for a financial solution vary by the beneficiary. Thus, you can generate revenue from user offerings, third-party services, or in-app transactions. When your app is released, you can add additional revenue streams, but a consistent business approach is necessary.

Subscriptions

A subscription-based model is one of the most common revenue models for all app types. In this case, users pay a recurring fee to access the app. We recommend offering a trial period first so that the users can explore the solution. After that, a subscription fee can be charged to bypass feature or content restrictions.

Transactional fees

In this model, the user pays a fee for each transaction processed through the application. Transaction fees apply either to all payment types or specific transactions. You can also combine this revenue source with the subscription fee.

Referrals and ads

Referral programs are among the most profitable collaboration approaches between companies and their partners. Thus, fintechs integrate with third parties that offer value to app users, whether through accounting services or additional fintech tools. The more users a referral or an ad reel brings in, the more commission the app owner receives.

Paid API access

Just like you can buy someone’s API, you can also provide your own if you are a payment gateway. Reusable functionality can be offered on a subscription or pay-as-you-go basis. Transaction fees and point-based earnings are also popular monetization options. PayPal, Stripe, and Amazon Pay are textbook examples of paid APIs.

Data monetization

Finally, you can generate revenue from available or real-time streaming data. Fintech is a rich source of valuable user insights. These may include purchase history, spending habits, average spending, and other customer habits. The immensity of this information can then generate valuable insights for your partners. However, your app’s policies must clearly state whether it shares or sells data to avoid potential misunderstandings.

Orangesoft's experience in building fintech apps

Over the years, our team has assisted global businesses in developing fintech solutions of different complexities. As a rule, we take over the project from ideation to delivery, thus providing turnkey fintech app development services.

We also build the back-end part of the app and feel comfortable stepping in mid-development. However, our UX/UI specialists prefer to validate the designs first to make sure your application is on the right track. Regarding the timeframe, it can take 2 to 15 months, depending on app complexity.

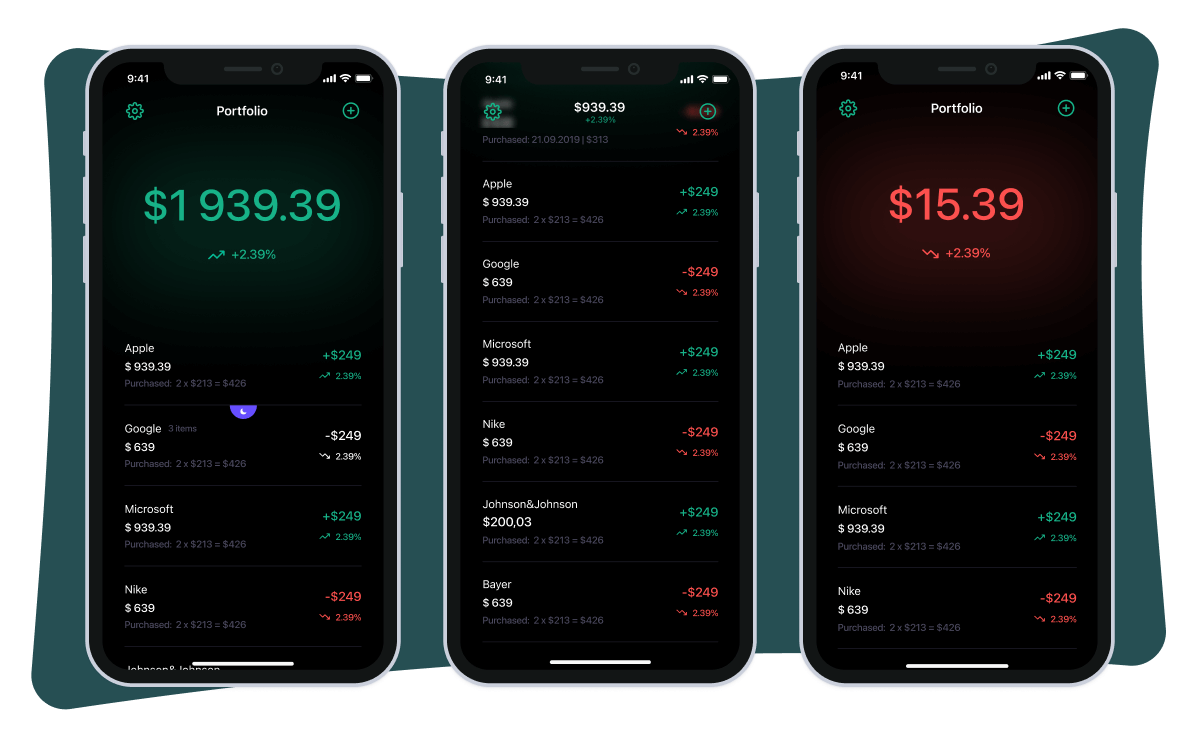

Our team is also well-versed in delivering all types of fintech apps. Thus, we have successfully delivered a stock portfolio tracking app for our US client. We designed and developed an iOS app that collects the user’s investment accounts from different brokerages into a single dashboard to give them a real-time view of every stock they own.

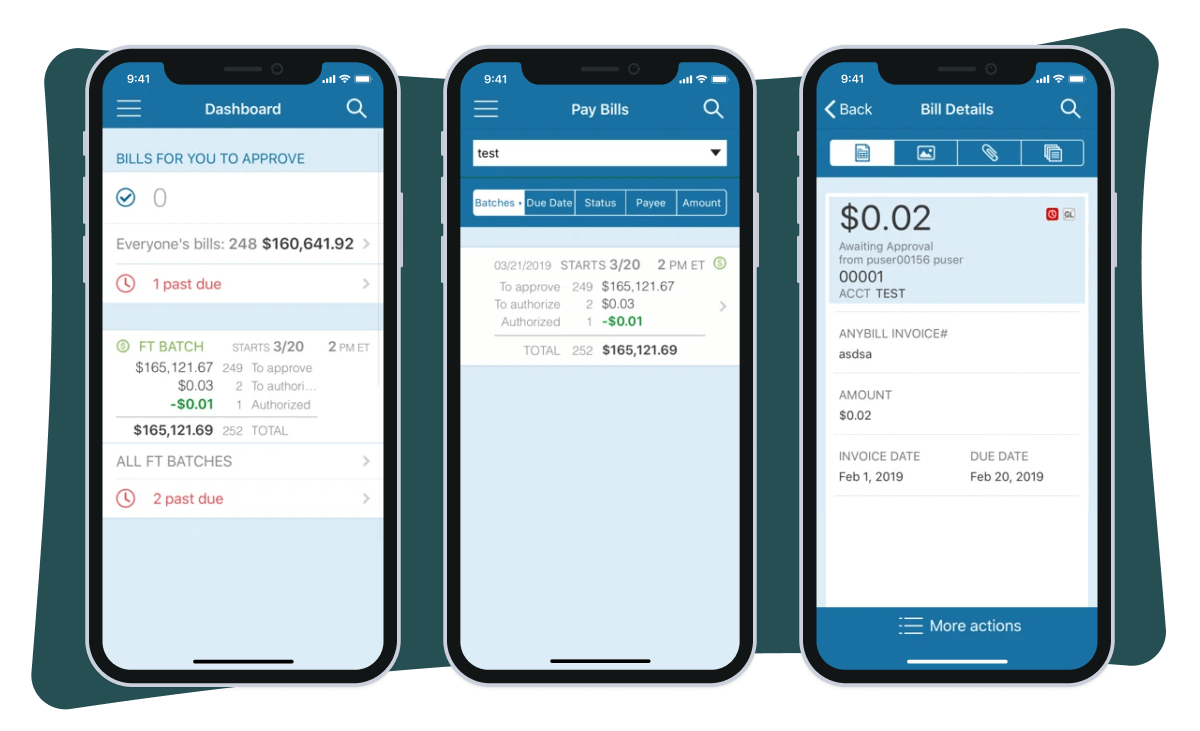

Another client of ours, who is a US provider of tax payment services, needed an iOS app for easier invoicing. Our team has helped the company to create a native mobile app to manage paper and electronic invoices with a real-time dashboard of bills and other critical features.

The future is fintech

Fintech is one of the fastest-growing sectors in global business today. Blockchain, AI, and other tech advancements are the linchpins of the financial world and will continue to shape it. As for mobile applications, they bring this tech combo directly to users’ pockets and simplify transactions. However, fintech app development is a challenging undertaking that requires hands-on expertise and best security practices.

If you’re still wondering how to build fintech apps, drop us a line, and our specialists will address your questions.