There are more than 5.1 million apps on the Apple App Store and Google Play combined. All of them can potentially generate millions of dollars, but only a small portion of apps hit it big.

If you are considering creating an application to unlock a source of revenue, there are different variables that should be entered into the equation. However, if revenue is the only reason why you want to create an app, you need to revisit your vision.

While seeing successful apps can tempt you to build a similar product, it is unlikely that you’ll pick up the same success as Revolut or Instagram. Before developing an app, research further and focus on the unique features that make popular apps profitable.

Now that you have an idea and a general vision of your app, you may have one question that restrains you from throwing yourself into this risky adventure: “How much money will I make?” Your answer strongly depends on your business niche, app platform, monetization strategy, and various other factors that we will discuss later in this article.

How does the platform influence potential earnings?

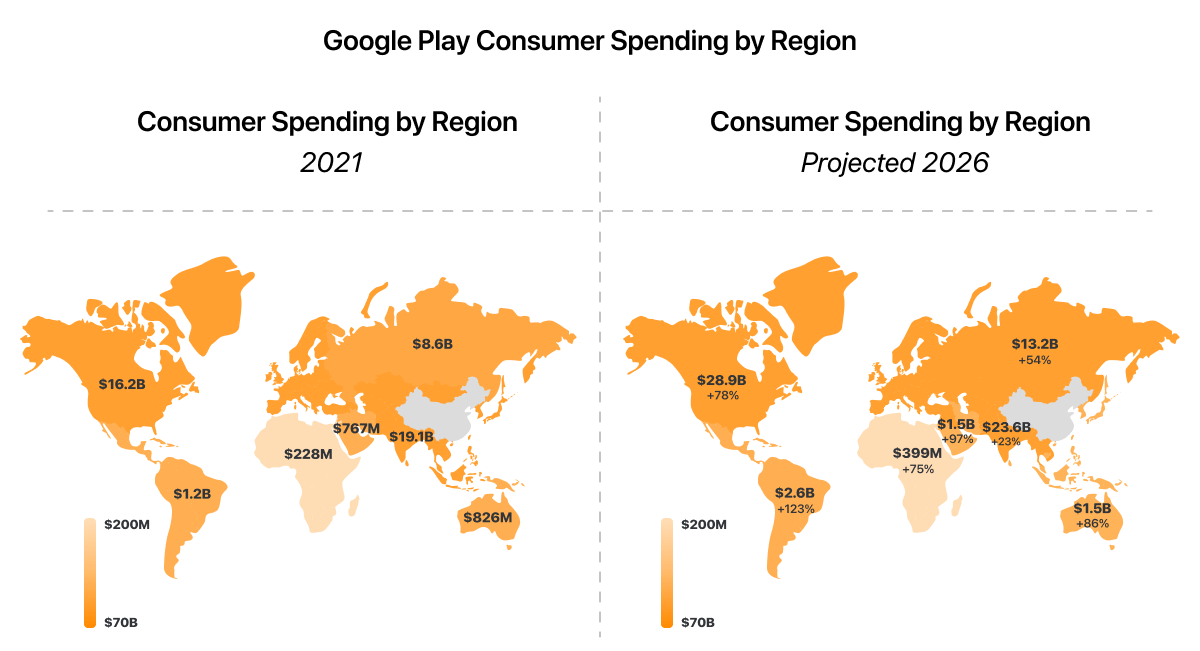

Platform choice can have a significant impact on your earning potential due to differences in market share, purchasing power, and overall platform popularity. According to Statista, the Android operating system dominates with a 70.5% market share, while iOS accounts for around 28.8% of the mobile market. However, the picture changes dramatically if you look at each region separately.

For example, users from countries like the USA, Canada, Australia, and Japan, as well as Scandinavian countries, prefer iOS, while users from Eastern Europe, some Western European countries, South America, Africa, and most Asian countries tend to choose Android devices. When creating an app, these regional preferences are vital to the implementation of your monetization model.

According to Sensor Tower, the highest growth rates on Apple’s App Store are expected in Africa, the Middle East, Latin America, Europe, and Australia. These statistics indicate that you should consider these regions for your target audience if you’re interested in an iOS app.

When looking at the growth rates for Google Play, it is predicted that the highest will be seen in Africa, Latin America, Europe, and Australia.

Beyond revenue predictions, another factor that should be taken into account is users’ purchasing power. According to Sensor Tower, Android consumers tend to be more economical, while iOS users spend more on subscription-based app downloads — around $13.5 billion in 2021.

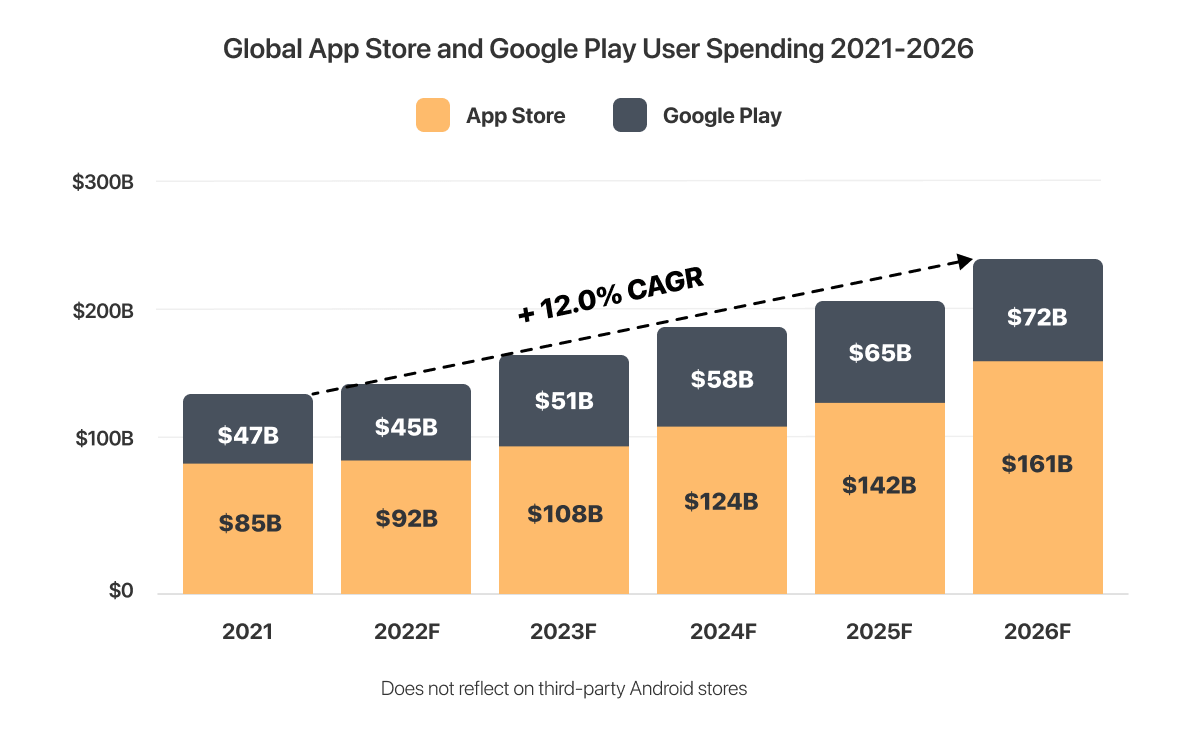

Now, let’s convert the stats above into money. The App Store will see a compound annual growth rate (CAGR) of 13.7% through 2026, reaching $161 billion of annual revenue, while user spending on Google Play is projected to grow at an 8.9% CAGR, hitting $72 billion annually within the next four years.

From the factors that we explored in this section of the article, it seems like Apple can guarantee more paying users due to its strong presence in high-revenue markets, while Google can give you wider market coverage and downloads.

Choose one or both of these platforms wisely because the income from your app depends on your decision.

What are the types of revenue models?

In addition to choosing the app’s platform, it is important to consider the monetization model that you will use. The good news is that you don’t need to reinvent the wheel. The beaten track of mobile development already has some popular and well-tested monetization models that will let you gain from your solution.

When choosing the best monetization option, you can leverage other successful companies’ experiences to see if any are viable for your project. Once you come to grips with popular monetization models, you can increase your revenue by adding additional money streams.

To better understand the most common revenue models, let’s first classify them into three categories:

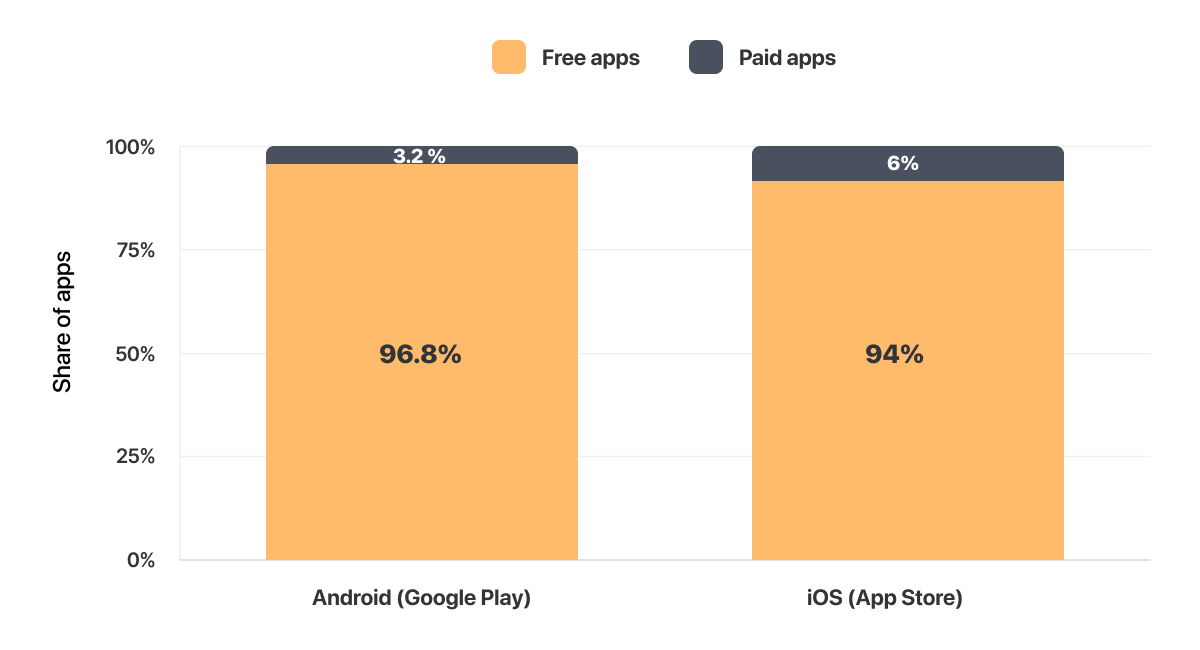

- Free apps: These apps don’t have any paid content but instead rely on advertising to generate revenue. Free apps can be downloaded and used for free.

- Partially free apps (Freemium): This is currently the most popular monetization model. Freemium apps can be downloaded for free, but the app limits users’ functionality to basic features. To unlock all features, the user needs to purchase a subscription or pay for add-ons.

- Paid apps: Premium or paid apps cost users a one-time download fee to install them from the app marketplace unless there is a free trial period. However, after the trial period is over, the user will need to pay to continue using the app.

Now, let’s see how you can make money using each of these payment models.

Free apps

Despite its name, this monetization model doesn’t presuppose charity. Instead, free-to-download applications can rake in money from in-app advertising.

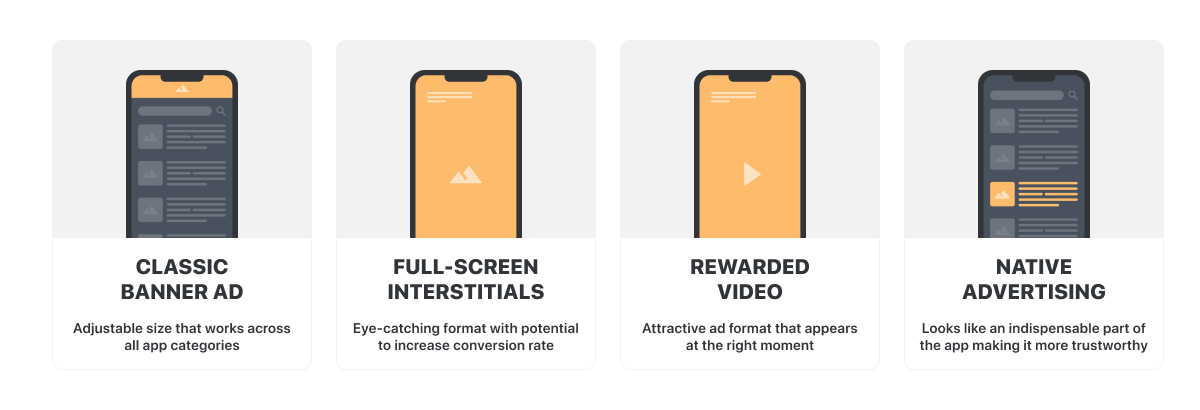

In-app advertising is a form of advertising that is embedded in the app, which means it will follow the user throughout their experience. Ads are usually placed at strategic points within the app to make sure they are seen by the user. For example, banner ads might be on top of a menu screen, or a video ad might pop up as you're watching your favorite show.

You, as an application owner, earn money based on users’ interactions with the advertisements displayed in the app. However, to make a good profit from your free app, you need to have an impressive user base.

The most popular affiliate marketing campaign types include:

- Cost per click (CPC): You get paid for each click on the ads displayed in your app. The revenue is calculated on a cost per mille (thousand) basis.

- Cost per view (CPW): The more times users watch the ads, the more money you get. This type of campaign typically relies on video ads.

- Cost per install (CPI): Advertisers pay for each install of their application from the marketplace.

The key benefit of the free app monetization strategy is that there is a great variety of ad formats, so you can choose the one that best suits your needs.

As you can see, there are a lot of options to choose from. However, unlike other monetization strategies, ads need to be tested and analyzed constantly, which leads to more frequent changes in terms of formats and placements.

Freemium apps

The freemium monetization model is a good alternative to choose if you are not into the idea of using ads in your app. Besides, users can engage with your free product without spending any money.

Using the freemium model means including in-app purchases or in-app subscriptions as the main revenue source. With this model, the app can sell supplemental content, including extra lives in games, virtual currency, ad removal options, premium content, etc.

There are some disadvantages to this monetization strategy that you should be aware of. According to AppsFlyer’s research, the majority of an app’s users won’t make an in-app purchase, as they have chosen to only enjoy the app’s free content.

However, you shouldn’t be afraid to use this model if you give your users content that has real value. By doing so, you gain their loyalty, which can then be converted into paying customers.

In this case, we believe that the best way to show users all the benefits of your app is to offer them a trial period. This way, you can prove that your product is worth their time and money.

However, keep in mind that both Apple’s and Google's app stores charge a fee between 15% and 30% on each transaction. The goal here is to strike the right balance between the service fees and the amount of money your users are willing to pay for additional content.

Paid apps

Paid apps charge a one-time download fee, allowing users to purchase an app with all its features. It is considered the oldest and most straightforward monetization strategy. In the early days of app stores, paid apps were the dominant monetization strategy.

Today, the statistics say otherwise, as free and freemium applications dominate the app marketplaces. The increase in demand for free and freemium apps pushes developers towards using these monetization models rather than the paid app model.

With the paid app monetization model, revenue is directly linked to the number of new users. If you can constantly bring in new customers and increase your user base, then the paid app model is the right choice for you.

Which mobile app categories generate the most money?

During the COVID-19 pandemic, home quarantine measures were introduced to flatten the curve and restrain the spread of the disease. People had to stay at home under lockdowns, and a smartphone was the only portal to the outside world. And as COVID-19 has accelerated the mobile surge, we expect mobile to take over even a greater share of our lives in the next few years. Time spent in apps has already surpassed 5 hours, up 9% from 2020.

Regarding potential earnings, revenue growth for apps on the App Store is expected to outstrip that from games. Thus, app revenue for non-game applications will reach $91 billion by 2026, compared to $70 billion from games. Overall, we can see a slowdown in consumer spending compared to the upturn in 2019–2021, when the COVID-19 pandemic made everyone turn to mobile.

Game apps will continue to take a higher share on Google Play than on the App Store, with a projected $47 billion in revenue by 2026 compared to $25 billion on the App Store. However, mobile game revenue is projected to tail off year-over-year in 2022 for the first time since at least 2014, partly due to the market correcting to the peak in 2020 during the pandemic.

Game apps

The global mobile games market is rapidly developing, driven by console-like graphics and dynamic gameplay experiences. This app category generated $110 billion in consumer spending in 2022, with downloads amounting to around 90 billion.

So, how do games make money? The monetization strategy in game apps usually depends on the game genre. For example, hypercasual games are usually free and don’t demand a strong skill set. For those games, the main source of revenue is ads.

Subway Surfer is an excellent example of implementing rewarding ads in order to get keys, an in-game hard currency. The app publisher doesn’t disclose data on the runner’s revenue. However, the game is reported to have made $80 million in worldwide player spending on iOS (in-app ads are not included). It also topped the App Store rankings, as well as overall as the most downloaded game, garnering approximately 86.2 million installs in 2022.

For other genres like simulation and casual games, which require a higher level of engagement and skill set, in-app purchases are used as the main form of monetization. Examples of this monetization model include Tencent’s Honor of Kings, which earned over $2.2 billion in 2022, and PUBG Mobile, which approached $1.72 billion in 2022. These two are the top-grossing mobile apps in 2022.

Both PUBG Mobile and Honor of Kings are free to download, but the real money is made through in-app purchases. For example, in Honor of Kings, users can pay to upgrade their characters, costumes, and weapons, and that brings in significant revenue when you consider the game’s audience of 100 million active users daily.

Dating apps

Even after the pandemic, love seekers didn’t abandon dating apps. In 2022, consumer spending on dating apps approached almost $6 billion.

The most popular monetization strategy used in dating apps is in-app purchases, specifically in-app subscriptions. A great example of a subscription-based app is Tinder, which generated about 41% of all the app’s in-app purchases in 2022, making it the most lucrative non-gaming app that year. In 2022, Tinder raked in a record-breaking revenue of $1.79 billion.

Tinder is free to download, but it makes money by offering premium features, including extra likes or unlimited swipes on a monthly or yearly subscription basis.

Bumble, a close competitor to Tinder, is the second-highest-grossing dating app, with an annual revenue of over $694 billion in 2022. Compared to Tinder, Bumble is more female-friendly, centered around women initiating conversations. While Bumble has a smaller user base, it exhibits higher-quality profiles and focuses on serious relationships rather than just hookups. Bumble’s monetization model is similar to Tinder, with premium add-on features called Spotlight and Boost.

With dating apps, the subscription model is not the only possible revenue stream. The majority of dating apps use a combination of in-app ads and subscriptions to rake in more money. In-app ads become the main revenue stream for free plans, while premium subscriptions are usually ad-free.

Entertainment apps

More and more people choose streaming, also known as over-the-top (OTT), services for their entertainment needs instead of paying for cable. Thanks to their more direct and personalized distribution over cable, these apps are prospering.

Over-the-top apps were both #1 for downloads and consumer spend in 2022. OTT apps accounted for over $786 million of consumer spend in 2022, with Gen Z being the most loyal audience for entertainment apps.

According to Sensor Tower, Twitch, Bigo Live, Netflix, and YouTube remain the front-runners in the entertainment app landscape.

Although Twitch’s dominance is pronounced, it lags in revenues compared with Bigo Live. Both apps generate most of their revenue through in-app purchases, namely subscriptions. In 2022, Bigo's revenues reached nearly $2 billion. During the same period, Twitch generated over $164 million through in-app purchase revenues worldwide.

Netflix and YouTube also remain in the center of the entertainment arena. YouTube totaled over $5 billion in cumulative consumer spending over the past ten years. YouTube generates revenue via sharing in-app ads and offering YouTube Premium to its audience.

Netflix thrives on a subscription video-on-demand (SVOD) model in which subscribers pay for a monthly plan. In 2022, its quarterly revenue reached $7.85 million.

Social apps

In 2022, the total time spent on social media apps climbed to over 2 trillion hours on Android apps. This app category is having a revival, driven by livestreaming, avatars, and a focus on video content. Monetization potential has increased as well, with in-app advertising netting the biggest payoff for this application cohort.

TikTok continues its reign as the top-grossing non-game app worldwide. In 2022, TikTok became the second non-gaming app to surpass $6 billion in all-time consumer spending. The application uses a combination of ads and in-app purchases, allowing users to spend real money purchasing TikTok coins to send virtual gifts to other users. In 2022, the platform also launched LIVE Subscription, a feature that lets users access exclusive content by their favorite creators.

Instagram has increased its ad load in pursuit of making $39.7 billion by 2023. In-feed ads on Instagram account for the majority of advertiser spend, joined by Stories and Reel ads.

Health and fitness apps

Amidst COVID-19 lockdowns, at-home fitness apps surged in global installs — from 1.97 billion in 2019 to 2.48 billion in 2021. Although this skyrocketing value was a one-off deal resulting from lockdowns, home fitness will continue to grow well into the future, with a projected market size of $23.98 billion by 2026.

MyFitnessPal is one of the top-grossing applications in the category. In 2023, MyFitnessPal made almost $12 million, mainly through subscriptions to its premium service. Strava follows with around $7.31 million in revenues, using premium subscriptions and sponsored challenges as its main revenue streams.

The leaders in the health and fitness category also include meditation apps such as Calm and Headspace, with revenues in 2022 of $83 million and $59 million, respectively. Both of these apps operate on a subscription-based model, allowing users to unlock additional premium features and offer in-app purchases, which allow users to pay for services and products related to sports and meditation.

Another popular app comes from personal trainer Kayla Itsines, and Itsines’s Sweat app is a great example for new app developers. Right after its release in late 2015, Sweat gained a stunning user base, which converted into $100 million in yearly revenue.

Itsines created a Bikini Body Guide (BBG) community, converting online fans into paying customers. How? By providing users with 28-minute workouts, yoga videos, and meal plans on a monthly or yearly basis.

Shopping apps

M-commerce has also emerged as one of the prominent market players due to the pandemic-induced online shopping craze. In 2022, time spent on shopping applications stood at 108 billion hours.

In 2022, customers gave high marks to Meesho and SHEIN as both have climbed to the top downloaded apps in the category. Being free to download, Meesho has accommodated 140 million transacting users and processed 1 billion orders. The platform makes money through seller ads.

SHEIN is also far beyond its competitors, with a recorded 6.8 million quarterly downloads, outperforming Amazon. The application is free to download, and the company makes money by selling products online.

Shopping apps are increasingly adopting livestream shopping as a supplemental or main option for discovering and purchasing new products. Livestream shopping apps have skyrocketed in installs, with 2.3 million downloads in the US alone.

In the United States, NTWRK and QVC grow in lockstep with the biggest number of installs, while Whatnot holds the most market share at 35%. The monetization options for this app category abound. Commissions, subscriptions, featured listings, and ad selling allow app owners to strike it rich with m-commerce.

Miscellaneous apps

On a smaller scale, other app categories can also generate a significant amount of money. For example, educational apps can offer you not only a profitable market but also a chance to make a positive impact.

Babbel is a good example of a lucrative language learning app, offering 10- to 15-minute lessons crafted by language experts and native speakers. This app makes its impact by focusing on conversational training rather than excessive vocabulary.

For revenue, Babbel uses a subscription-based model and doesn't have any in-app ads that distract users from learning, as other educational apps have. Babbel’s monetization strategy resulted in €188 million in revenue in 2021.

In 2023, educational apps are expected to gain traction to $70.55 billion in revenue by 2026, fueled by the continued growth in collaboration and video conferencing apps.

All the apps mentioned above show a huge difference in revenue potential based on category. Currently, the most profitable app category is games due to higher consumer spending.

Additionally, video and audio streaming apps, as well as dating apps, are among the most lucrative categories. Plus, the booming health and fitness app category also demonstrates impressive revenue potential. However, you shouldn’t forget that there is plenty of room for prosperity in other app categories.

Remarkably, all the top-grossing apps operate on a subscription-based model that encourages users to switch to a premium mode to experience the app’s full potential. This monetization strategy is especially beneficial for apps with dynamic content, like games and streaming apps.

Is it profitable to develop apps for other smart devices?

It is not a surprise that apps can be found on other smart devices nowadays. Thanks to the growing popularity of the Internet of Things (IoT) and connected devices, the wearable technology market reached $115.8 billion in 2021. By 2028, its market value is projected to reach $380 billion.

Currently, wearable devices are especially popular in the wellness and healthcare industry, as they offer real-time information about a user’s overall health, including data on blood pressure, glucose levels, quality and quantity of sleep, steps taken, and other information about day-to-day activities.

The market of wearable devices is segmented into eyewear, headwear, bodywear, wristwear, footwear, and other wear. If you have any thoughts about choosing this market, you’d better take a closer look at the eyewear and headwear product segments because they are predicted to thrive in the next few years.

Another kind of smart device that is gaining popularity is smart TVs. Because of the rising trend of video-streaming media, the number of smart TV consumers has also been increasing.

The global smart TV market size stood at over $197 billion in 2022 and is expected to expand at a CAGR of 11.4% from 2022 to 2030. The most popular apps used on smart TVs are ones that already have a large user base, like Netflix, Hulu, and YouTube.

Finally, rapid AI development gave birth to virtual assistants, like Alexa and Google Assistant, that can play music, read out the news, and tell you the weather. It is expected that the smart speaker global market will earn over $34 billion annually by 2028.

As you can see, apps don’t have to be strictly tailored to mobile phones, and you should keep smart and wearable devices in mind when designing your app. Diversifying your app can be beneficial both in terms of exposure and additional revenue streams.

Key takeaways

“How much money can apps generate?” is a question that might not have a definite answer, but the statistics on different apps’ revenue can help give you a general understanding. For example, games and entertainment apps have the potential to be billion-dollar earners. And there is also significant earning potential in less complex apps and smart devices.

Based on our research, we’ve seen that the majority of the industry giants prefer a subscription-based monetization model, and this model is often combined with other streams of revenue. So, don’t forget about other smart devices when designing your app.

There are endless possibilities to make a profit out of mobile apps. Doing your research on platform differences, revenue models, and the most popular app categories can help you develop the ideal monetization model that fits your app idea.

Orangesoft's mission is to help businesses grow with the help of our mobile app development expertise. If you're stuck wondering how you can create a successful mobile app, contact us for a free consultation.